The cost of medical care — even for those who have health insurance — is keeping some families from seeking treatment.

About 25 percent of adults in a recent poll said that they or a family member have avoided seeking medical attention because of the cost, according to a survey of 1,002 adults that Bankrate, a personal finance website, conducted in May.

"People across the board, regardless of the coverage they have, seemed to have a high level of health-care insecurity," said Robin Saks Frankel, credit card analyst at Bankrate. "They are concerned about the quality of coverage and the costs associated."

Here's how even insured individuals can end up facing steep bills:

High-deductible plans

More than three in 10 of the survey participants said that their main source of coverage was through work.

About 36 percent said they were covered through a government program such as Medicare or Medicaid, and 12 percent said they bought their own private insurance.

Having coverage doesn't guarantee that you'll be able to afford care when you need it, though.

For instance, research from the Employee Benefit Research Institute shows that workers using a high-deductible health plan saw the doctor less frequently.

This was particularly the case for low-income employees, who saw the doctor less often for preventive care and reduced their use of flu vaccines, according to EBRI.

Trade-off on savings

High-deductible plans tout lower monthly premiums, as compared to traditional insurance.

In 2016 the average annual premium for employer-sponsored health insurance was $6,800 for single coverage in a preferred provider organization (PPO), according to data from the Kaiser Family Foundation.

However, the average annual premium for a high-deductible health plan available at work was $5,762, Kaiser found.

There's a trade-off for the lower cost of coverage: You are responsible for saving the amount of money you need to meet a higher deductible.

Under a high-deductible plan, employees can use a tax-advantaged health savings account (HSA) to cover qualified medical costs. These plans must have an annual deductible of at least $1,300 for self-only coverage or $2,600 for families, according to the Internal Revenue Service.

Out-of-pocket expenses each year may not exceed $6,550 for individuals or $13,100 for families.

"Don't automatically choose the cheapest plan and hope you won't need it," said Bankrate's Frankel. "You might choose not to go to the doctor because you don't want to pay the out-of-pocket cost."

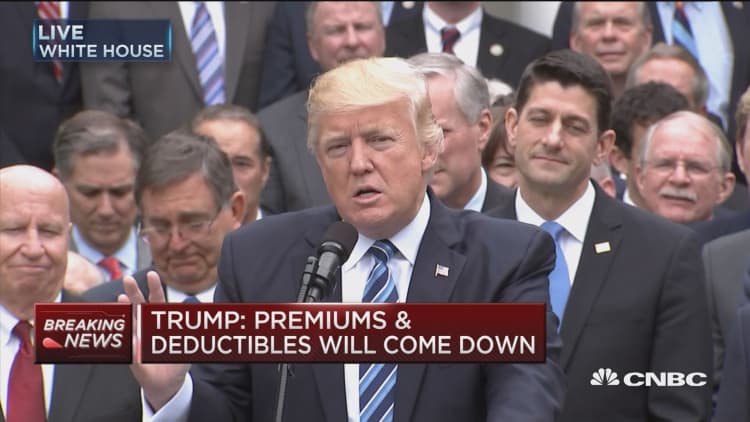

High-deductible plans and HSAs have been central in the health-care debate. House Speaker Paul Ryan and fellow Republicans have sought to increase the amount individuals can contribute to their health savings accounts.

For 2017, HSA holders with self-only coverage can contribute up to $3,400 annually, while those with family coverage can save up to $6,750.

Assets in these accounts continue to climb and may surpass $53 billion by 2018, according to Devenir, an HSA consulting firm in Minneapolis.

Wrangling health-care costs

How Congress proceeds on health care remains to be seen. In the meantime, you should maximize the benefits you have available to you this year:

Don't delay your annual checkups: It's best to uncover any underlying health problems early in the year, treat them and hit your deductible before the year ends.

Assess low-cost health-care alternatives: See if your plan grants access to a nurse call service. They can provide guidance on whether a problem is serious enough that you need to see a doctor.

Stay in-network when you can: Preventive care under the Affordable Care Act — which is still in effect — covers these services free of co-payments, co-insurance or deductibles as long as you stay in-network.

Know who is out-of-network: Expect to shell out for care from anesthesiologists, radiologists, emergency care physicians, assisting surgeons and pathologists. These individuals are often out-of-network and what you pay may not go toward your annual deductible.