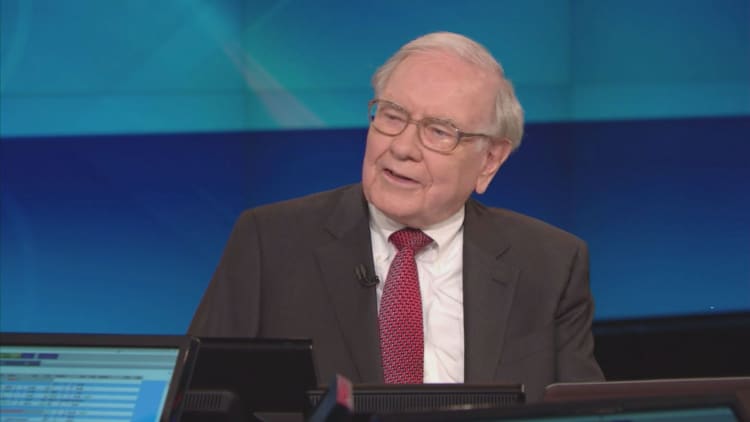

Wall Street is questioning the value investing strategy espoused by legendary investors such as Warren Buffett after a decade of weak returns.

The value "strategy's poor performance has coincided with a swell of assets into passive equity investment strategies as well as quantitative and 'smart beta' funds," Goldman strategist Ben Snider wrote in a report Wednesday entitled "The death of value?"

"The disconnect has led investors to question the future viability of value investing, which has been embraced by the academic literature and espoused by investors including Benjamin Graham and Warren Buffett," he added.

Snider noted the value investing long/short strategy based on Eugene Fama's and Kenneth French's work generated an average annual return of 5 percent from 1940 to 2007.

"The simple strategy – buying stocks with the lowest valuations and selling those with the highest – realized a theoretical gain in seven out of every 10 years and never spent three full years below its previous high water mark," he wrote.

However, in recent years performance has faltered. The strategist said investors that used the same long/short value strategy generated a 15 percent cumulative loss in the past decade and negative returns in 6 out of the last 10 years.

Snider explained why the returns have suffered:

"Value has historically posted its strongest returns during periods of strong economic growth early in the economic cycle. The factor typically wanes late in the cycle as investors search for secular growth opportunities when economic growth slows. Concerns about the possibility of 'secular stagnation' in recent years have compounded the investor hunt for growth."

Goldman Sachs' chief U.S. equity strategist, David Kostin, also told CNBC on Tuesday why growth stocks outperform in sluggish economic environments.

"A modest growth environment means that growth is still relatively scarce. So the growth stocks … [where] tech is a prominent area, are likely to continue to do well and outperform," Kostin said on CNBC's "Squawk on the Street."

But perhaps investors should heed history. The last time Wall Street questioned Buffett's favorite strategy it preceded a strong multiyear run for value investing.

During the height of the dot-com bubble in 1999, when technology growth investing was crushing the market, Buffett defended value investing in a classic column for Fortune magazine.

"At Berkshire we focus almost exclusively on the valuations of individual companies, looking only to a very limited extent at the valuation of the overall market. Even then, valuing the market has nothing to do with where it's going to go next week or next month or next year, a line of thought we never get into. The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value. Sooner or later, though, value counts." - Warren Buffett, Fortune Nov. 1999

And to be sure, Buffett's value style differs from Goldman's simplistic study. The Oracle of Omaha says he looks for good companies with strong management and competitive advantages at a good price. And he never explicitly stated you need to sell a stock once the valuation got "high."

In the end, Goldman's Snider is not giving up on value investing.

"We believe that value will remain a good long-term strategy, although future returns will likely be lower than the historical average. Behavioral finance suggests that some value premium will persist even as changes in the investment landscape reduce its expected returns going forward," he wrote.

Watch: Inside Buffett's vacation home