As industrial stocks enjoy some upward action in the stock market, Jim Cramer wonders if the global economy is really improving and taking United States' companies with it.

"I think to myself, forget President [Donald] Trump, forget U.S. infrastructure, we're going to see some pretty good growth overseas, and the buyers here are trying to get ahead of the excellent quarterly numbers that these companies will likely start reporting less than a month from now, no doubt aided by a weaker dollar," the "Mad Money" host said.

Cramer turned to 3M, a large manufacturer with international exposure, to prove his point. Since its last earnings report, the stock moved up 13 basis points and broke through the $200 level.

Because 3M's stock tracks the company's progress closely, its jolt upward told Cramer that the next quarter is shaping up to be a strong one thanks to the Post-It maker's end markets.

Watch the full segment here:

"Remember, only 40 percent of 3M's business is in the United States, and that means its industrial and electronics and graphics divisions won't be kept down by sluggish growth here," Cramer said. "More important, when you look at the broad portfolio and the many countries their products are sold in, you're not only going to see organic growth, but even currency-aided growth as the U.S. dollar is not that strong."

The "Mad Money" host expects no different from the likes of Honeywell and United Technologies, both of which also have widespread product portfolios and over 40 percent exposure to the weak U.S. dollar.

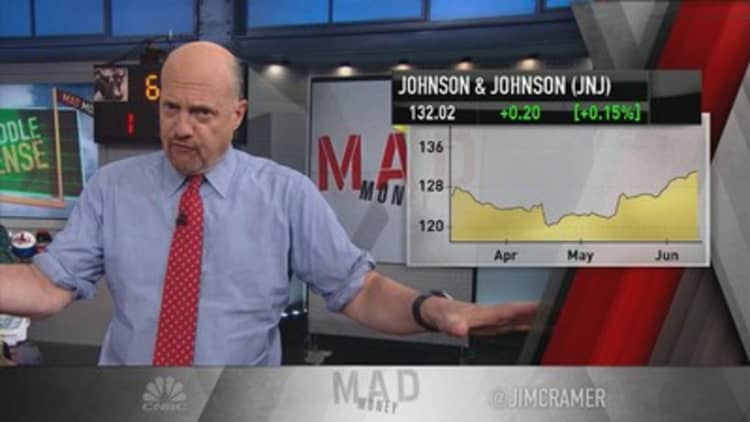

Cramer sees these as part of a larger cohort of stocks that will benefit from a weaker dollar, like that of Johnson & Johnson, a pharmaceutical company that has long had currency headwinds.

"Same goes for IBM, which I think is trying frantically to put in a bottom here, with its new businesses trying so hard to outrun the old ones. IBM's been savaged by Warren Buffett, but perhaps he soured on it right at the cusp of the turn," Cramer said. "Now it's clear that these stocks, with the exception of IBM, have already put on some serious points."

Finally, Cramer thinks the weak dollar tailwind could be a boon to one unexpected, non-industrial company, Procter & Gamble, for two reasons.

"One is that almost no company has spent as much time as these guys explaining why it's been hit so hard by currencies all over the globe, and some they can't even hedge," the "Mad Money" host said. "Second, now GE's Jeff Immelt has been replaced by [John] Flannery, I believe that Nelson Peltz and his Trian Fund, which agitated and militated against Immelt when they didn't make the numbers, will turn their attention to Procter & Gamble."

Like with General Electric, Cramer expects Trian, Peltz's noted activist fund, to issue a white paper to Procter & Gamble's management recommending certain cost cuts.

Also like GE, Cramer expects shares of Procter & Gamble to pop once the company announced it will move forward with the cuts.

"Time to get involved yourself with a great American company that gives you so many ways to win, especially with Peltz in there fighting for you," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com