With the stock of Coca-Cola on the rise after a downturn in 2016, Jim Cramer decided to track the soft drink giant's transformation to see if changes at the company will brighten its future.

But to understand the company's future, investors need to understand its past, the "Mad Money" host said, turning to 2008, when the company appointed Muhtar Kent as CEO.

In the past five years under Kent's leadership, the stock of Coca-Cola lagged, climbing only 40 percent compared to shares of its top competitor, PepsiCo, which rose 95 percent.

"The reason? A lot has to do with the global shift away from soda, which is Coca-Cola's bread and butter. Carbonated drinks have become the slowest growing beverage category around, whereas PepsiCo has its Frito-Lay and Gatorade business to diversify away from the weakness in sugary sodas," Cramer explained.

Watch the full segment here:

Despite Coca-Cola's best efforts to diversify, which included introducing healthier, low-sugar alternatives like juices and partnering with Monster Beverage for a footprint in the energy drink space, sales still slumped.

However, in December, Kent announced that he would step down and hand over the CEO role to James Quincey, the company's former president and COO.

Since the announcement, Coca-Cola shares have gained momentum, even speeding past PepsiCo stock's pace in the last three months, causing Cramer to wonder whether Coca-Cola is making a serious comeback.

His first hint came from the Consumer Analyst Group of New York, or CAGNY, conference in February, a gathering of consumer goods companies and experts from across the industry.

At the conference, Coca-Cola executives laid out a strategic plan for the company's transformation, including a new approach to the carbonated business — a combination of massive product releases, with 500 released in 2016 and 500 more planned for 2017, and acquisitions, which involve purchasing small, but promising brands and selling them globally.

To tackle the issue of its core products' nutrition, Coca-Cola also introduced smaller packages and started to change the way it labels nutritional information to make the products more attractive to customers, along with the release of more low- and no-sugar beverages.

Cramer added that the company is at the tail-end of a multi-year initiative to re-franchise its bottling business by spinning off the low-margin, low-growth bottlers it once acquired.

"On top of that, the company also talked about embracing a leaner, more agile operating model. We didn't get too many details here yet, but we know it involves reshaping their local business units and doing a better job of hiring executives and managing their performance. Plus, the new Coca-Cola wants to bet more heavily on digital," Cramer said.

In its last earnings report, the company delivered a top-line beat and a slight earnings miss with 3 percent organic volume growth. Management gave Wall Street an update on its transformation efforts, seeing an uptick in low-sugar drink sales and acquiring a soy-based drink maker.

Coca-Cola also announced it would be laying off 1,200 workers in the second half of 2017 with more firings coming in 2018 in an effort to streamline the business and cut costs, expecting to bring its total cost cuts to somewhere around $4 billion.

"Maybe it's taken Coca-Cola too long to re-calibrate itself. I get that. But now they have a new strategy, a new CEO and the leanest structure it has had in ages. That matters, and the profits will flow right through to the bottom line in a much fatter way than I think people realize," Cramer said. "The company understands that it needs to find new ways to win in a world where many consumers just don't want to drink soda anymore."

The question Cramer finds himself asking is: "Can James Quincey, the freshman CEO, actually deliver on these turnaround plans?"

With the company slated to introduce digital efforts, refreshed recipes, re-franchised bottlers, cost cuts, and across-the-board innovation, Cramer wonders if that is too big of a to-do list.

"But you know what? I don't think Muhtar Kent would've let Quincey take over if he didn't believe the guy has what it takes," the "Mad Money" host said. "If I know Kent, and I think I do, he's giving Quincey the best hand possible as part of his graciousness ... and his desire to make things as easy on his successor as possible. That's his way."

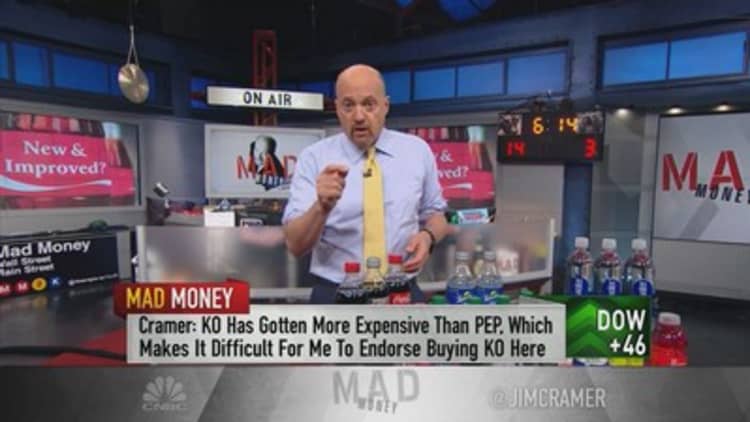

While the company is the early stages of its turnaround, Cramer still finds it difficult to endorse the slightly expensive stock, which trades at 24 times earnings compared to PepsiCo, which trades at 22 times earnings and is already on its way to re-forming its soft drink business.

"I think Coca-Cola is worth watching for the possibility that this transformation they've talked about is going to really happen," Cramer said. "But if you're thinking about owning a beverage stock, I'm still going to recommend sticking with PepsiCo. Nevertheless, you know what, if you wanted to buy some Coke now and wait for a pullback, you have my blessing. I think the company's set up for a real good 2018, and you may have to start buying it now to get in on those gains."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com