When a small-capitalization stock that has been downtrodden for months starts to see a turnaround, Jim Cramer takes notice.

That is why the "Mad Money" host decided to look into the business behind Rent-A-Center, a chain that sells consumer goods like appliances, computers and furniture on a rent-to-own basis, where customers pay off the cost of the merchandise they take home in installments.

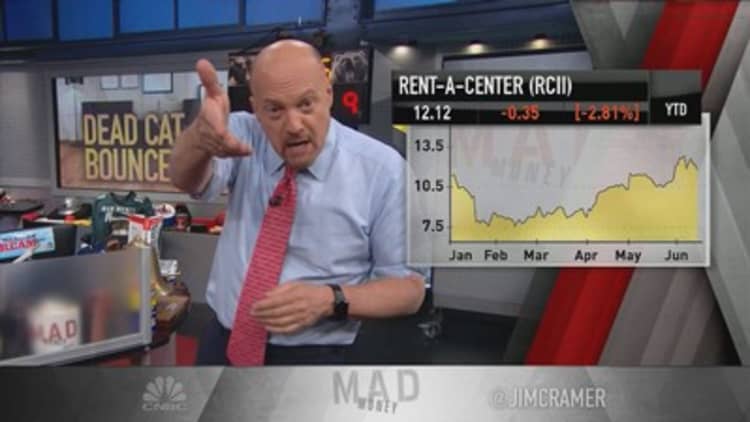

"Rent-A-Center's stock is down 70 percent from its all-time high set nearly four years ago, and that attracted me. But lately it's begun to bounce and bounce hard, so this could be interesting. Right now, the stock's up 8 percent year-to-date. It's rallied more than 50 percent from its 52-week low back in January," Cramer said.

Following that, Cramer wondered if the bounce is sustainable and presents an investment opportunity or if the company is truly in dire straits.

Watch the full segment here:

With over 3,000 locations in North America, Rent-A-Center has made some promising developments recently that Cramer said could mend things at the retailer.

"The company's founder, Mark Speese, recently returned to his previous role as CEO, there's an activist firm in there pushing to make changes, and just last week we found out that they're shaking up the board of directors. Plus, the company's made some operational changes," Cramer said.

But to understand the company's brightening prospects, Cramer insisted that investors must first understand how the stock got to be so punished in the first place.

After years of solid revenue growth, Rent-A-Center saw a big decline that started in 2013 and continued through 2015, reporting underwhelming fourth-quarter earnings along the way.

"Then last year the company's numbers just fell off a cliff," the "Mad Money" host said. "One day, the company's revenue, they reported, declined by nearly 10 percent, same-store sales shrank by 6.2 percent, and the earnings per share just fell apart, down 62 percent. Ouch."

Then came the activists, namely a firm called Engaged Capital, which bought a 4 percent stake in the company. In the first quarter of 2017, the firm expanded that stake to 17 percent.

Engaged's first step was contacting Speese, Rent-A-Center's founder, to talk about boosting value and exploring strategic options, which Cramer said was "code for thinking about putting the company up for sale."

A month later Speese was reinstated as CEO, and Engaged started to agitate the company's board, eventually nominating five new members.

Then another activist firm, Marcato Capital Management, got involved with the company via a 4.9 percent stake, reinforcing Engaged's calls for a board shake-up and a potential sale.

Over the course of the activists' involvement, Rent-A-Center reported double-digit declines in its same-store sales, a measure retailers use to verify the health of their businesses.

"But when the company reported in May, the earnings were slightly better than feared and the stock rallied 11 percent on the news, even as the same-store sales continued to decline by 7.8 percent," Cramer said. "In short, business is not that great, and for the most part, the stock has been rallying on the hope that the activists can accomplish something."

While the company did not provide guidance for 2017, it announced a new strategic mission to change its pricing to draw more customers and giving renters the option of paying the rest of the cost early to go straight to owning their items.

At Rent-A-Center's annual meeting a week ago, Engaged's nominees won all three board seats that were up for election, asserting much more influence and increasing the chances for a sale.

But even with all of the positive changes the activist firms might bring, Cramer's biggest problem with the company is that its fundamentals are still weak. Buying the stock now is a bet on Engaged and Marcato finding a buyer willing to pay up for the company, he said.

"After years of mismanagement, it's possible that Rent-A-Center could finally be able to turn itself around, and people have been buying it on that. The stock's been roaring also, because of Engaged Capital and Marcato's plan to push for a sale. But you know what? Here's where I come out: I think this is way too risky, to buy the stock of a retailer with plummeting same-store sales based on the hope that someone might want to take it private," Cramer said. "I can see so much why you're tempted to speculate here ... but for me, Rent-A-Center is way too risky. I say don't own it, don't even rent it, there are better fish to fry."

Rent-A-Center responded to Cramer's analysis in an emailed statement to CNBC:

"Rent-A-Center is executing on a comprehensive strategic and financial plan to restore long-term growth, drive improved profitability and maximize value for all stockholders," the company wrote. "The pillars of the plan include strengthening the core U.S. business; optimizing and growing the Acceptance Now business; and leveraging technology investments to expand distribution channels and integrate retail and online offerings. These initiatives are already delivering substantial progress in key performance metrics, including significantly improved same-store sales and reductions in delinquencies. We are confident that the continued implementation of this plan will create value for all of our stakeholders and return Rent-A-Center to its position as the industry leader."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com