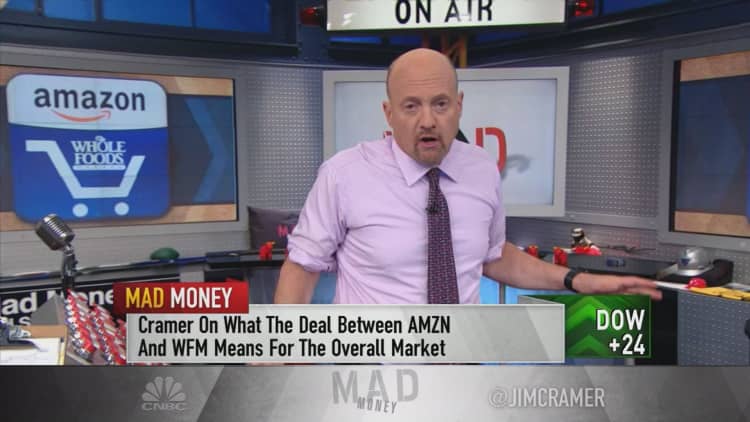

In light of Amazon's game-changing, $13.7 billion bid for grocery chain Whole Foods Market, Jim Cramer had to address the deal's disruptive power and who stands to gain and lose the most.

"Today is a day that will live in infamy for everyone who sells groceries in this country," the "Mad Money" host said on Friday. "I don't care if you're Kroger or Wal-Mart or Target or Costco or Supervalu or Dollars General and Tree or the recent German entrants [Aldi and Lidl], this purchase? It changes everything."

Cramer compared Amazon's landmark offer to an army bolstered by mechanical weapons and an air force fighting against cavalry. Amazon, with its non-union workforce and stellar delivery system, would do to the supermarket what the e-commerce giant did to the mall, he said.

Whole Foods' footprint is still relatively small, with roughly 400 stores across the United States, but the high-end grocer has had standing plans to expand to 1,200 stores in some years' time.

Watch the full segment here:

While those plans got sidetracked when activist firm Jana Partners took a stake in the company and started pushing for a sale, Cramer said Amazon's takeover could bring them new life.

"I know anyone in grocery was crushed by this today and that makes sense, at least initially. Yes, it's that much of a disruption to have the company that wanted to clothe and entertain you decide that that's not enough. Now wants to feed you, too," Cramer said.

Cramer added that purchasing Whole Foods would solve Amazon's problem of not being able to offer fresh products, providing the retailer with a distribution platform and well-known brand.

Amazon would then be able to distribute Whole Foods' products at a fraction of the market value it will likely gain from the acquisition.

As follows, the clear winners of this deal are Amazon and Whole Foods, Cramer said. Amazon's technological know-how will make shopping at Whole Foods much simpler, from cutting down the long lines to expanding loyalty programs to streamlining mobile payments, he argued.

Whole Foods' shareholders also stand to gain from the deal for obvious reasons, Cramer said. For one, Whole Foods' stock jumped 30 percent when news of the deal broke on Friday.

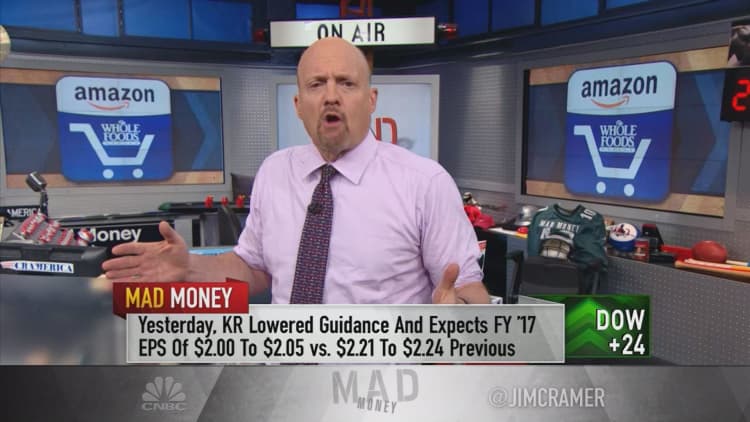

But that concludes the deal's few key gainers, with losers aplenty, the "Mad Money" host said. First on the losing list is the highly leveraged Supervalu, which Cramer said is in no shape to compete with the rest of its cohort.

"Next is Kroger, which has an expensive, unionized workforce and is already struggling with deflation," he said. "I didn't see how Kroger could compete yesterday after that downbeat rap about all of the other companies seeking to take share. Now it's even more un-investable."

Cramer wonders if Target, another retail giant struggling to incorporate food into its business, might decide to outsource its food to Kroger like it outsourced its pharmaceutical arm to CVS.

"If I were Brian Cornell, Target's CEO, I would make that call to Kroger right now," Cramer said.

Finally, Whole Foods' suppliers, namely United Natural and Hain Celestial, could be hit because Amazon would have jurisdiction over telling them how much they should spend on their products.

Cramer would not advise owning either name, especially not Hain, which is embroiled in legal issues surrounding its accounting methods.

"In some ways, I feel it's too small to really just talk about these individual companies, though, because it, frankly, throws you off the much larger scent," Cramer said. "I think the grocery industry has gone from being a not-so-hot area to invest in to [being] basically hideous overnight."

And while top competitors like Wal-Mart may keep pace with Amazon — or, rumor has it, may even put in its own bid for Whole Foods — Cramer said this deal's effects will nevertheless weigh heavily on the supermarket space.

"Most of the supermarket stocks had a nice bounce back from the misery of the morning. Somehow, I believe many will see, unfortunately, those lower levels again. I say be cautious," the "Mad Money" host said. "The revolution is here. Amazon's desire to clothe and feed and entertain every American cannot be denied. It will be realized. And things will not end well for all of Amazon's competitors because cavalry? Let's just say it never had much hope against tanks."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com