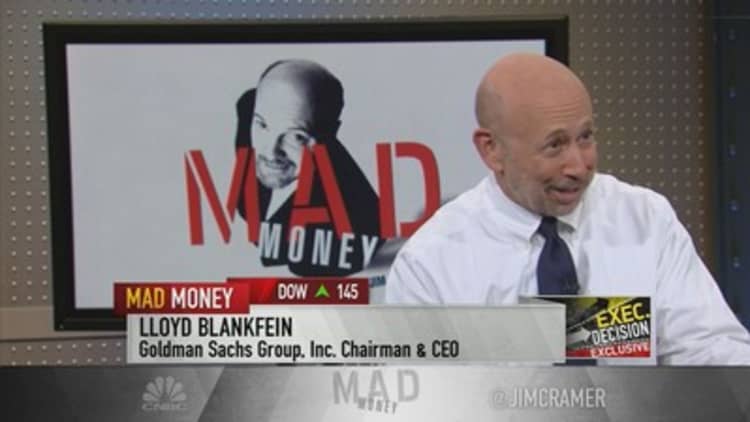

The 2008 financial crisis hit the global economy hard, and Goldman Sachs Chairman and CEO Lloyd Blankfein, who led the company through it, said it may still take institutions a while to recover.

"You had a severe banking crisis, which always takes time to sort out because, again, banks are, in a lot of ways, the transmission mechanism for economic growth," Blankfein told "Mad Money" host Jim Cramer on Monday. "You can change interest rates, but at the end of the day, someone has to lend and the banks have to be in better shape so they have to be recapitalized. So if you do it by comparison to the Great Depression, that took 10 years to sort out. At the end of the day, this might also take 10 years to sort through."

Blankfein added that he had to credit the country's federal organizations for guiding institutions through the crisis.

"We didn't have 25 percent unemployment in the country [like in the Depression]," Blankfein said. "In fact, it never got to really 10 percent unemployment, and I think all that stimulus, all that interest rates being dropped to 0, all that quantitative easing in this country, achieved ... [a] shallower recession."

Watch the full segment here:

The CEO said that for Goldman Sachs, there were two parts to the crisis: the existential part, where the banks and lenders that were hardest hit by the crisis questioned the system and those who had to fail failed, and the reputational part, where Goldman employees and others who came out of the crisis still functioning wondered how the managed to stem the blow.

Blankfein acknowledged that Goldman was fined for wrongdoing, but said that it is difficult to look at the crisis in retrospect and figure out why nobody really saw it coming.

"It was bad behavior. But who got it right?" the CEO wondered. "Did the Fed get it right? Did the pundits get it right? Did all the observers of the financial market who were active then say, 'You're lending too much money against real estate, this is a dangerous thing?'"

And, at the end of the day, Blankfein admitted that it was much easier to look back at how the crisis unfolded than to have ever predicted back then the damage that would be done.

"It was a bubble that burst and, in hindsight, I'm much better identifying bubbles in hindsight than I am in foresight," he told Cramer.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com