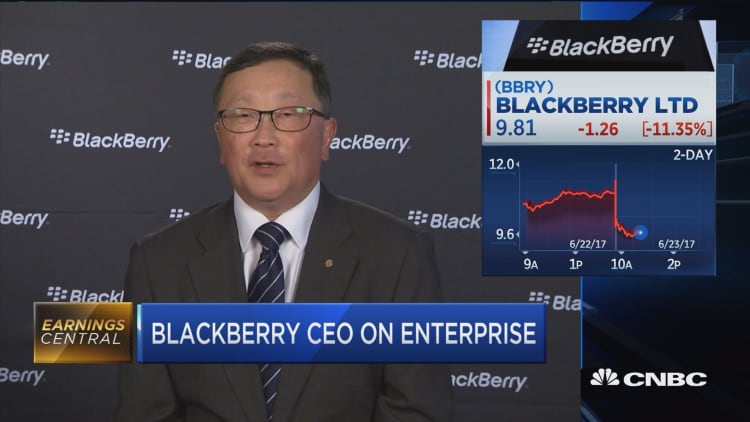

BlackBerry shares dropped more than 10 percent on Friday morning — but those who follow the company know it's "about to break out," CEO John Chen told CNBC.

"We will be doing acquisitions," Chen told "Squawk Alley" on Friday. "If you follow the company for a while, you know that we are about to break out and do some investment in growth. That's part of our big plan here."

Though known for its iconic mobile phones, the Canada-based BlackBerry is now primarily a software company, with products such as cybersecurity shields and the QNX automobile platform. The company said last year it would spend nearly $75 million over the next few years on a self-driving car hub.

Chen said some cybersecurity projects are likely to contribute to this year's earnings and that space might be ripe for acquisitions.

"The newer area of machine learning, as related to cybersecurity — we're already a leader in that space," Chen said. "We really would like to add more capability and features there. That's one part of it.

"Anything that we could apply back to both our automotive business as well as our enterprise business, as we talked about," he said. "And the other area is expanding the channel and the reach for our auto business. We have a very commanding lead in the market for auto software. .... We've got to expand our footprint in reaching much more globally."

Despite Chen's optimism, Wall Street didn't react well on Friday to BlackBerry's latest financial results.

BlackBerry earned an adjusted 2 cents per share, excluding items, on revenue of $244 million in the first quarter. That's better than the breakeven level expected by a Thomson Reuters consensus estimate, although BlackBerry's revenues fell short of the $264.4 million expected.

The light sales were due, in part, to a drop in its high-margin software and professional services sales. Chen said the company's financial results were complicated by transactions that have taken place over the past few years.

"A year ago, we had a revenue from the good technology acquisitions that came off the balance sheets. So if you take that off ... the year-over-year growth of our enterprise business was actually 12 percent," Chen said. "So it's not as people think — that it's not growing at all."

BlackBerry was also boosted by a $940 million windfall from a dispute with Qualcomm.

"The relationship is actually quite good. We had a disagreement [with Qualcomm] over the licensing and the contracts," Chen said. "Both sides had agreed to be friendly, whatever the outcome would be. We happened to come out, in my mind, the right way. But we are also working a lot on technology ... We are working together, we enjoy working with each other and we respect each other as companies."

Still, Chen said in a statement the company intends to be profitable on an adjusted basis for the full year and to generate positive free cash flow, even without the Qualcomm arbitration award.

BlackBerry shares are still up nearly 41 percent over the past year.

BlackBerry has a slight advantage over its rivals, Chen said, in that it has proximity to some of Canada's top college engineering programs.

"This area is booming," Chen said. "The company has turned. We are doing well. From a financial point of view, we are investing. People like that, especially young talent."

— Reuters contributed to this report.

WATCH: CNBC puts the first-generation iPhone to the test