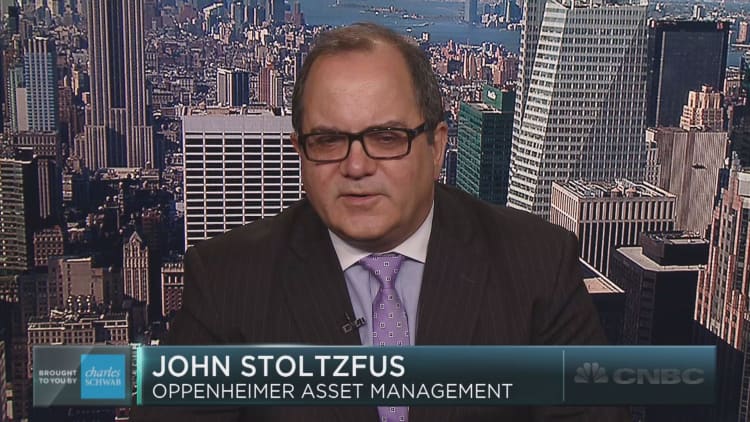

Oppenheimer Asset Management's John Stoltzfus is finding himself in an unusual situation.

The S&P 500 has already closed above his bullish 2017 price target, and it's not even the second half of the year.

"We think there's likely opportunity for us to raise it," the firm's chief investment strategist said Monday on CNBC's "Trading Nation." "We just need to consider it a little bit further. If we get any stimulus out of Washington, that may make us more enthusiastic. But we expect to have a new target within the next three to five days."

When Stoltzfus put out his year-end price target of 2,450 last December, it was the second highest on the street. The officially broke through it on June 19. Since then, the index has fallen slightly.

"The question is how much higher, based where we are related to economic growth of 2 and 2½ percent," he said. "Earnings have been getting stronger, although consensus is looking for a slight weakening in earnings in the second quarter."

The S&P has soared nearly 9 percent this year.

Stoltzfus expects the bull run to continue, as more investors come off the sidelines to invest in stocks. He believes they will start to acknowledge that interest rates "are not going to rise exponentially."

"With 74 to 78 million Americans in the baby boomer generation, that means to us that people are going to be looking for functionality," said Stoltzfus, who points out the 10-year Treasury yield is only around 2.1 percent.

He also argues that the Federal Reserve is effectively navigating the current economic climate, and inflation will not emerge as a headwind. Stoltzfus says wage inflation is contained.

Yet there are always risks.

"It will raise [rates] in very small increments, and it will be able to space those hikes so they will not be quite as much as a shock to either the bond market or the stock market — though there is vulnerability in the bond market," Stoltzfus said. "It's just as rates rise, they are bound to feel some effect."