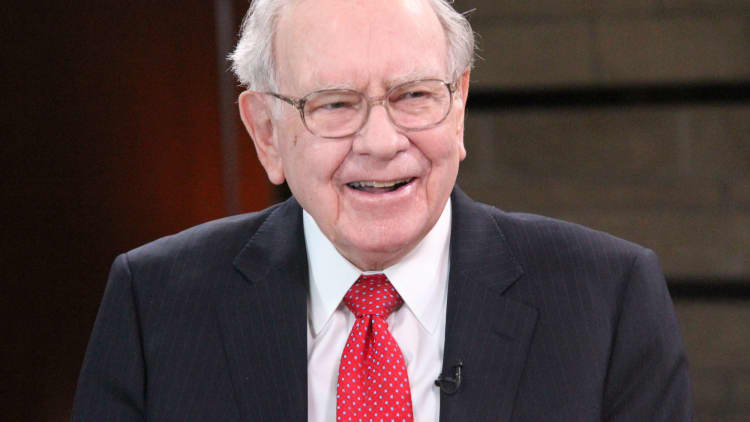

Bank of America has cleared the way for Warren Buffett's Berkshire Hathaway to become its biggest shareholder.

Berkshire has warrants to buy 700 million common shares of Bank of America at $7.14 each, or about $5 billion. And Bank of America just did what Berkshire was waiting for: after passing the second of two annual stress tests by the Federal Reserve, it got the go-ahead to hike its annual dividend to 48 cents a share, or 12 cents a quarter, a 60 percent increase.

That is enough for Berkshire to consider exercising those warrants rather than waiting until just before their expiration in 2021. At Bank of America's current share price, the stake would hand Berkshire a tidy $11.7 billion profit, at least on paper.

It all goes back to Berkshire's 2011 deal to invest $5 billion in preferred shares of Bank of America, which at the time was struggling with numerous legal issues in the wake of the subprime mortgage crisis. The preferred shares pay a 6 percent annual dividend, or $300 million. At a dividend of 44 cents, the common shares would pay roughly the same. At 48 cents, Berkshire would get $336 million annually.

A move to exercise the warrants would be seen as bullish for Bank of America shares, an expression of confidence by Berkshire that they have upward momentum. They rose 2.6 percent on Wednesday, to close at $23.88.

Berkshire would also become Bank of America's biggest shareholder, surpassing Vanguard, which holds 6.6 percent, about 652,000 shares, according to FactSet.

Mr. Buffett has not talked often about the Bank of America stake. In the past, Berkshire indicated it would likely not execute the warrants until right before the 2021 deadline. But in his annual letter to shareholders, Buffett signaled a change of heart.

"If the dividend rate on Bank of America common stock – now 30 cents annually – should rise above 44 cents before 2021, we would anticipate making a cashless exchange of our preferred into common."

The letter noted that Bank of America has been repurchasing shares, which it views favorably. "We very much like this behavior because we believe the repurchased shares have in most cases been under priced. (Undervaluation, after all, is why we own these positions.) When a company grows and outstanding shares shrink, good things happen for shareholders."

There was no word from Berkshire immediately after the bell whether they would take action, and a phone call wasn't immediately answered. It seems Buffett would likely take this action as long as he believes Bank of America's stock would remain stable to higher.

WATCH: How Warren Buffett makes long-term investments