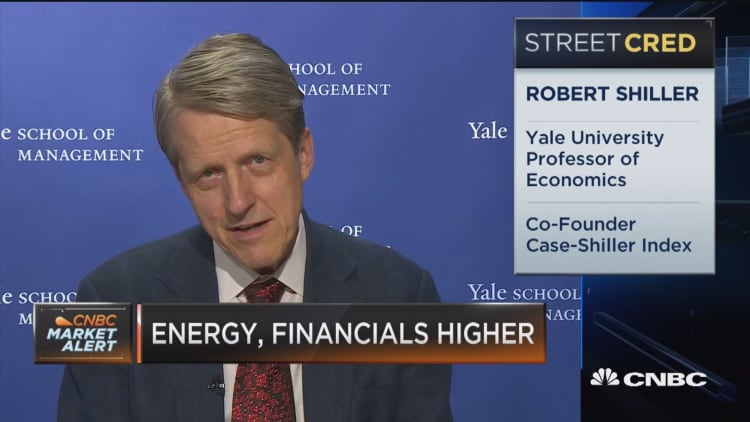

Investors need to tread carefully right now because market valuations are at "unusual highs," Nobel Prize-winning economist Robert Shiller told CNBC on Thursday.

In fact, the only times they have been higher were in 1929 and 2000, the Yale professor said. Both years saw historic market crashes.

Shiller was referring to the valuations measured by the cyclically adjusted price-earnings (or CAPE) ratio he developed with John Campbell. The metric compares current prices to average earnings over the past 10 years adjusted for inflation.

"We are at a high level, and it's concerning," he said in an interview with "Power Lunch."

However, he said, "it's not definitive" and it sustained high levels in the 1990s for a number of years.

"People should be cautious now," Shiller said. "We have a high market. That doesn't mean I would avoid it altogether."

He recommends diversifying — including investing overseas and in "low CAPE" sectors.

On Thursday, U.S. stocks plunged as technology stocks sold off and washed out gains from the big banks.

— CNBC's Alex Rosenberg and Fred Imbert contributed to this report.