Oil prices plunged 4 percent on Wednesday, ending the longest bullish streak in five years, as more evidence indicated OPEC exports rose last month.

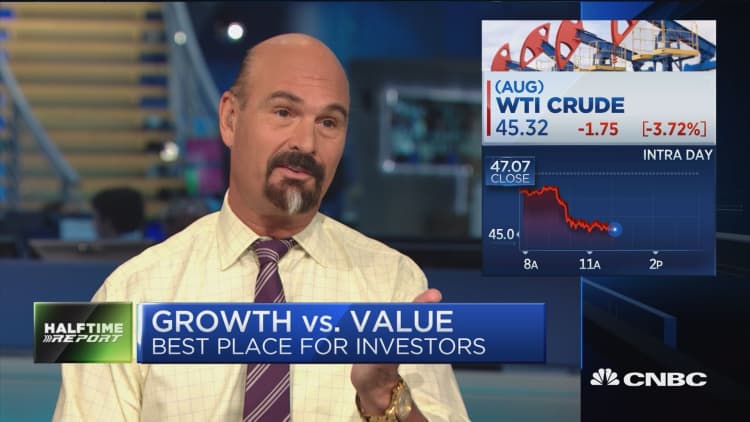

U.S. West Texas Intermediate crude futures ended the session down $1.94, or 4.1 percent, at $45.13 per barrel, erasing much of the previous two sessions' gains. International benchmark Brent crude futures slumped $1.85, or 3.7 percent, to trade at $47.76 per barrel 2:37 p.m. ET.

WTI prices rose nearly 11 percent from a 10-month closing low over the course of eight sessions, the contract's longest winning streak since 2012.

"We're in no man's land as this tug of war of this rebalancing act continues to play out," Jeff Kilburg, founder and CEO at KKM Financial, told CNBC's "Futures Now." He said he expects U.S. crude prices to remain stuck in a range of $42 to $47 a barrel.

WTI crude futures, source: Factset

Bearish sentiment crept back into the market on Wednesday after data from Thomson Reuters Oil Research showed OPEC's exports rose in June. This was despite the producer group reaching an agreement in May to extend a deal to keep 1.8 million barrels a day off the market in order to shrink global supplies and end a three-year glut.

OPEC exported 25.92 million barrels per day in June, up 450,000 bpd from May and 1.9 million bpd more than a year earlier, according to Reuters data.

CNBC reported last week that shipments from top oil exporter Saudi Arabia and other OPEC members were on the rise in June, citing analysis by tanker tracking firm ClipperData.

OPEC and other oil exporters including Russia have entered a seventh month of production cuts, but analysts remain concerned that exports have not fallen as quickly as output this year.

"Everyone continues to fight for market share and not necessarily constrain supply to the global market, and that realization I think has registered today," said John Kilduff, founding partner at energy hedge fund Again Capital.

Saudi Arabian state oil giant Saudi Aramco on Wednesday said it would cut prices for light crude grades to customers in Asia in August, a sign of rising competition in the key demand hub.

"That indicates that the production scheme is just not helping prices," Scott Nations, chief investment officer at NationsShares, told "Futures Now."

A report that Russia has ruled out deeper production cuts also weighed on markets, Nations said. Russia is the largest non-OPEC contributor to the output cut deal.

Some analysts on Wednesday said oil prices were poised for a fall after the sharp rise through Monday. They said the surge was driven by traders closing out short positions, or bets that oil prices would fall.

"We had a frothy move higher driven by short covering as negative bets had gotten nearly as high as they had been when oil was at its lows last year, so we were bound to see a bit of a reversal with traders taking profits ahead of tomorrow's inventory report," Tamar Essner, director, of energy and utilities at Nasdaq Corporate Solutions, told CNBC in an email.

Traders are awaiting the latest data on U.S. crude stockpiles on Thursday, which are delayed by one day due to the July 4 holiday. Analysts expect stocks to fall by 2.8 million barrels, according to a Reuters survey.

Kilduff attributed part of the recent bullish run to traders covering shorts ahead of Independence Day, which overlapped with a deadline for Qatar to respond to demands by a coalition of Arab nations that has enforced a blockade against the small Gulf monarchy.

Some of the geopolitical risk premium appeared to be coming out of the oil market on Wednesday in the absence of an acceleration of tensions, Kilduff said. Qatar's foreign minister on Tuesday said the Saudi-led group's list of demands is "unrealistic and is not actionable." On Wednesday, he called for dialogue to end the diplomatic crisis.

— Reuters contributed to this story.