The economy is expected to have added 179,000 jobs in June, but economists are more concerned about whether workers got a raise.

The lack of inflation in the economy — wages and prices — has been a concern to some Federal Reserve officials, who have signaled they are willing to look past it for now.

But some of the first kindling for warmer inflation should show up in the labor force with wage increases, and pay is just creeping higher. Economists expect to see a 0.3 percent rise in June, or an annualized pace of 2.6 percent after May's 0.15 percent increase, according to Thomson Reuters.

"I was looking for a low [nonfarm payrolls] number of 150,000 because we're starting to get retail layoffs," said Diane Swonk, CEO of DS Economics. "The real conundrum is whether we get any wage acceleration. I'm more concerned about that."

Swonk said the biggest outlier in the wage data for May was the manufacturing sector, which saw an annual increase of just 1.4 percent.

Seth Carpenter, chief U.S. economist at UBS, said the average hourly wage data in the employment report may have become a bigger focus, but even so, Fed Chair Janet Yellen has indicated she sees the soft inflation data as transitory.

The focus on wages has intensified since the Fed indicated it hopes to begin reducing its balance sheet as well as raise interest rates before the end of the year. Markets have been skeptical that the Fed will be able to raise rates again this year.

"There's likely to be an upward trend [in wages] because the labor market is tight and it's getting tighter," Carpenter said. "Lots of people are focused on it. I think the focus has shifted more and perhaps too much more on the monthly [CPI] inflation number."

Carpenter said he expects 155,000 jobs and there could be a 15,000 hit in education, based on the technicalities with the end of the school year. In May, job creation was just 138,000, less than expected.

"Tomorrow's a big day. You could see a pretty big knee-jerk reaction if the number misses consensus by 25,000 or 30,000," said Carpenter.

Economists expect to see unemployment remain at a low 4.3 percent. Carpenter said he will be looking for more signs that slack in the labor market is diminishing.

Ben Herzon, senior economist at Macroeconomic Advisers, expects to see 168,000 jobs.

"For the next several months, we have a number like the 168,000 assumed. We haven't seen much of a change when you look at GDP growth averaged over a couple of quarters. You're still running at 2 percent," Herzon said.

"The economy is growing at a moderate pace but given the trends of productivity it's a fast enough pace to keep job growth at a pretty healthy level," he said. "As far as wages, if you squint you can kind of see an upper trend in wage growth."

Herzon said the wage data has been volatile, but it is running at about a 2.5 percent pace if you look over a number of months. He said wage and price inflation move higher in tandem.

"They both kind of move together in a way that's reflective of overall resource utilization in the economy," he said. "I focus on it because labor income is a driver of consumer spending. Consumer spending is two-thirds of the economy. You want to see that households have income to spend to keep the economy moving along."

Stephen Stanley, chief economist at Amherst Pierpont, said the volatility in wage data seems to be related to the timing of the survey week for the government employment report.

He said wage hikes tend to be below trend when the survey period is early in the month and higher when it is later. "Given the survey reference period in June, there are widespread expectations for a firm monthly reading," he said, adding he expects a 0.3 percent rise.

"These monthly gyrations have also wreaked havoc with the year‐over‐year advances, which have swung from as high as 2.9 percent in December to 2.5 percent in May, the lowest reading in over a year," Stanley said. "This gauge is likely to accelerate to 2.6 percent or possibly even 2.7 percent in June. In short, the June wage figure is likely to arrest some of the chatter about wages being dead, at least for the time being."

Even so, the bond market will be keenly focused on the wage data as a metric of inflation. Strategists say the jobs number could be make or break for bonds, which have been selling off on expectations that the Fed and other central banks are moving away from easy policy.

"Tomorrow's jobs report looms as a potential catalyst for a breakout in yields, or, if wages remain weak, it will prove another reason why yields can't get off the ground," wrote Thomas Tzitzouris of Strategas Research in a note.

"[W]ages will be the key factor in whether U.S. yields continue to rise; consensus is for about 2.6 percent average hourly earnings, but anything in the 2.4 percent to 2.7 percent range has been viewed as just a continuation of the low wage trend of recent years," he wrote. "A print above 2.7 percent raises optimism, and a print near 3.0 percent requires a broader assessment of the low inflation argument."

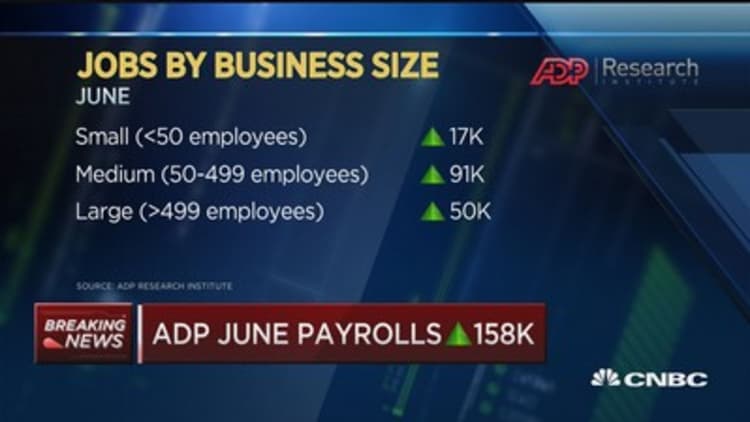

Watch: Zandi says June ADP payrolls show consistent economy