Few things get Americans excited like bacon, so with wholesale pork belly prices up sharply this year lovers of the meat should brace for sticker shock at the supermarket.

At the same time, restaurants serving up bacon cheeseburgers, BLTs or other menu items with the American favorite may see those higher prices, too, which could take a bite out of profit margins.

Cash prices for wholesale pork bellies, a cut of pork sliced to make bacon, are up 71 percent since the start of 2017 through Thursday, according to commodity research firm Urner Barry. On the retail side, it shows the weekly retail average for brand-level bacon was up 21 percent in the same period.

"Seasonally, this increase makes sense," said RaboResearch analyst Steve Nicholson. "It's grilling season, so if you're making bacon cheeseburgers you have to have bacon." Even more, it's the season for bacon, lettuce and tomato sandwiches, he said.

In addition to the seasonal period of high demand, tightness in supplies of pork bellies have supported prices.

Pork bellies typically go into cold storage at the end of the year when there's excess supply and lower demand. During the recent winter months, though, robust demand continued for both bellies and bacon so industry supplies were unable to get fully replenished.

Indeed, U.S. Department of Agriculture figures showed December 2016 ended with the lowest supplies of pork bellies in cold storage during a December going back to when the department began tracking the number in 1957.

"The cold storage is crucial for bellies in particular, along with a number of other cuts, because the summer is our lowest pork [production] period," said Russell Barton, who reports on the pork market for Urner Barry. "But it is also our highest bacon consumption period, so we need the excess supplies that were thrown into cold storage to compensate for the shortfall of fresh product."

The fact that the pork bellies didn't get replenished enough during the winter means there are low supplies and high seasonal demand pushing prices higher. But the supply situation is expected to ease starting in the fall due to more expansion in the hog sector.

Regardless, retail bacon prices are typically slow to reflect changes in the wholesale belly market, and Barton said not all of the jump from the cash trade will get transferred to the consumer.

There are various reasons why retail bacon prices are not showing the huge increase found in the cash prices for wholesale pork bellies. For one, there can be longer contracts that retailers have with certain suppliers so they might be able to maintain prices longer without huge swings. Retailers also may decide to take a margin hit on bacon to boost traffic in stores or hold off for competitive reasons.

According to U.S. Bureau of Labor Statistics data, the average price of a pound of sliced bacon has remained at or above $5.69 per pound nationally in the past three months, or elevated levels not seen since 2015.

Based on the BLS data, the average national price was up about 60 cents per pound from December 2016 to May 2017, or approximately 12 percent. The government's June price data on bacon hasn't been released.

Even though bacon is a favorite food, there's still only so much of a price increase consumers may be willing to take before they cut down on it.

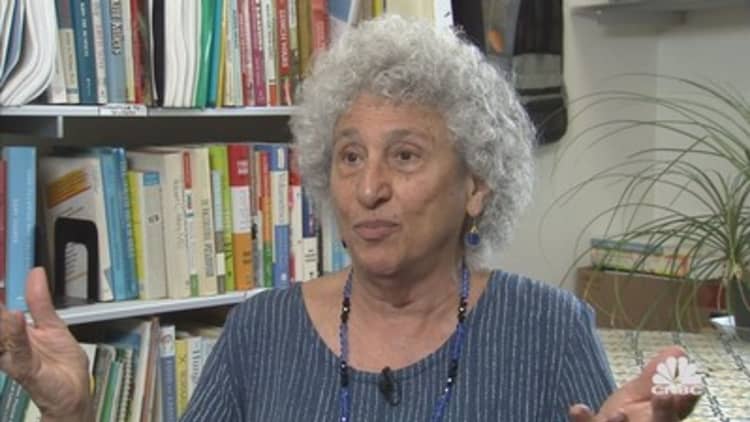

"People are just going to buy a little less…or be more frugal," said Meagan Nelson, associate director at Nielsen Fresh, a food data researcher. For example, she said they may have fewer strips of bacon for breakfast or cut down on the amount they use in recipes "to make it stretch a little bit further."

Nielsen scan data shows the price of packaged bacon has risen about 50 cents since January, and in April and May there was a slowing of sales volumes of bacon. In April alone, there was a 20-cent jump in packaged bacon from the prior month and it likely contributed to April's sales volumes falling 2 percent.

Supermarkets commonly feature bacon in weekly ads to drive more traffic to stores. Analysts say the grocers may still hold off on making any larger increases or switch more promotions from brand-name bacon to private label to deliver better margins.

"Features (or weekly newspaper advertisements) do drive a lot of demand for meat products or animal protein products in stores," said Nicholson. "That's because the consumer is focused on price and value right now."

Private label bacon has maintained a market share of about 21 percent pretty steadily over recent years, according to researcher Mintel. The rest of the market is controlled largely by four major bacon producers led by Kraft Heinz.

"Consumers tend to regard bacon as kind of a commodity, so I don't know if brand makes as much of a difference in this category as maybe some others," said Billy Roberts, a senior food and drink analyst at researcher Mintel.

Mintel figures show Kraft Heinz and its Oscar Meyer brand have about 20 percent market share in the domestic retail bacon market. Other large companies include Smithfield, Hormel and Tyson.

Across the entire pork category, Nielsen research shows bacon was the only area seeing significant growth in the 52-week period ending in April. In other words, bacon was doing better than fresh pork, luncheon meats and sausages.

Nonetheless, Mintel shows sales growth of bacon today remains in the low single-digits and below what it was some five years ago.

"The early part of the decade saw a crest of popularity in bacon and sales growth to match it," said Roberts. "It hit its peak around 2013-2014 when sales were growing at about 10 percent over that time."

He said the slower growth of bacon today may also be due to more food-service chains offering "all kinds of uses for bacon on menus," and not just burgers and BLTs but products like bacon-flavored ice cream or shakes.

About 80 percent of the top-500 restaurant chains have some sort of bacon item on the menu, according to market researcher Technomic. Bacon is used for breakfast, lunch and dinner, as well as appetizers and desserts.

As an example, Arby's Restaurant Group sold about 55 million items with bacon last year, which included limited-time offers and menu classics. The chain just finished its first week with the Triple Thick Brown Sugar Bacon sandwich lineup, which a spokesperson said "is performing very well in our restaurants."

"Many of the burger chains promoting something have a bacon play in there," said Joe Pawlak, managing principal at Technomic. "They don't have a lot of room to take it off the menu."

Pawlak said what usually happens during periods of sizzling bacon prices is the restaurant operators become "more cautious" about how much of it they are using and make portion adjustments or other changes. And he isn't expecting the major food-service chains to pass on higher prices in the short term but adds that if the prices remain elevated in the long term "they will obviously have to make adjustments."

Major restaurant chains, particularly those in the fast-food sector, use hedging or forward contracting to mitigate any price spikes in meats, including bacon. Pork belly futures no longer trade on the Chicago market, but the lean hog futures are used by some restaurant companies to hedge price risk on bacon.

The Chicago lean hog futures contract for August was up more than 30 percent in the second quarter. The contract also set a new high earlier this week and ended Friday at 83.3 cents a pound.

Hog futures still remain below the 2014 peak when there was an outbreak of Porcine Epidemic Diarrhea virus, or PEDv. The disease killed around 10 percent of the U.S. hog population.