Oil sold off sharply Friday, as U.S. producers again added drilling rigs, but it's those very drillers that could be the reason oil prices may find a bottom around $40, analysts say.

The U.S. shale oil industry has become a swing producer, affecting prices globally, and its output has become a lever as other major producers, like Saudi Arabia and Russia, cut back on production. Analysts say the U.S. industry is expected to continue adding oil to the market this year, but because of low prices, its growth for next year may slow. U.S. oil output last week reached 9.34 million barrels, including growth from U.S. offshore drillers.

Francisco Blanch, head of commodities and derivatives strategy at Bank of America Merrill Lynch, said the shale industry may actually be the force that locks oil prices into a range, with a bottom just above $40 per barrel. Blanch recently cut his forecast for average West Texas Intermediate prices to $47 per barrel for this year and $50 for next year.

"The bottom line is if oil falls below $40 per barrel on average, which is why I don't see a lot of downside, we start to lose shale," Blanch said. "In the context of OPEC not waging a price war, we need prices high enough to encourage some amount of shale drilling."

Blanch said between $40 and $60 a barrel, there is a potential 2 million-barrel-a-day swing in U.S. shale supply. "If prices are $55, we think shale supply grows by 1.1 million barrels a day," he said. For every dollar the price moves, the supply is affected by 100,000 barrels, he said. "Under $45, you're now moving into contraction territory on a forward basis."

WTI futures closed at $44.23 per barrel Friday, off 2.8 percent on concerns about rising U.S. output and increase in OPEC exports. WTI oil futures hit a low of $42.05 on June 21 and have been swinging volatilely since then.

Citigroup analysts also see a more bearish case for oil, with the prices heading toward the $50s this year, instead of the $60s. "We still think the direction is up, but the probability of rising as high as our base case is lower," said Citi energy analyst Eric Lee. Lee said the prices have probably come close to the bottom though analysts say it is still possible oil could take another leg down.

One factor pummeling oil this week has been increased exports by OPEC, as Nigeria and Libya both added more barrels to the market than expected. Analysts say, though, that the 1 million barrels a day from Libya have come without any significant increase in political stability in that country so it may not be a continuing source of so much supply. OPEC is also expected to try to bring both countries into some framework in its production agreement.

Just over half the analysts in a recent CNBC survey say oil prices have likely found a bottom in the low $40s.

Greg Priddy, director of global energy with Eurasia Group, agrees that oil prices may be near or have made a bottom. "I don't think there's a strong reason to head a lot lower than where we are right now. I still think we'll see modest inventory draws in the second half on the extension of the OPEC cuts.

"The market is expecting more growth from Libya and Nigeria than is really the case in the future," Priddy said. "I think they're both about maxed out by now."

Blanch also said he does not see much further price declines. "I don't see a lot of downside below $40/$45 range. Maybe we get a little bit of a dip below but I just think the market is pretty oversupplied.

"Inventories are finally declining, but the real issue is we need to have forward prices low enough to discourage shale," said Blanch. "We need to see a slowdown in the fracking industry, and we just added 12 rigs, which doesn't help at all."

Blanch said forward prices for 2018 in the futures market are just above $46 per barrel, enough to allow more production but not a good price for higher cost producers to hedge. He said the breakeven is an average $54 per barrel, though it is clearly lower in some regions and for some companies.

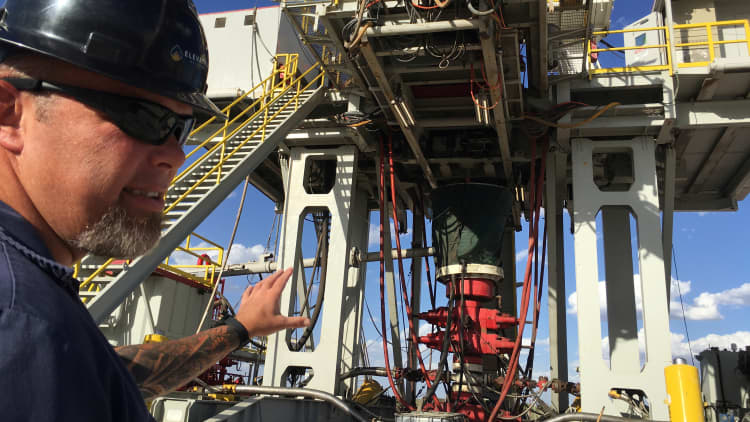

"If they hedge production at the current price point, and now calendar prices for next year are below $50, they are locking in a loss," he said. Blanch said he is hearing from industry executives that since they can't hedge, they plan to cut capital spending outright for next year, meaning less investment in drilling. U.S. rig count has increased to 952, and has been up 24 of the last 25 weeks, according to Baker Hughes data.

U.S. rig count has increased to 952 and has been up 24 of the last 25 weeks, according to Baker Hughes data.

Blanch said his price outlook would be affected by unexpected events, such as a recession or a geopolitical development. For instance, events surrounding Qatar are uncertain and if they affect the OPEC agreement that could impact prices.

Watch: Will oil go from sizzle to fizzle?