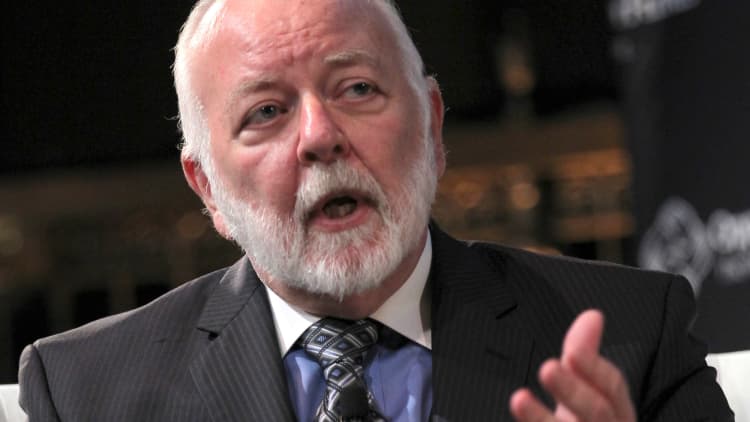

Closely watched analyst Dick Bove is not interested in buying bank stocks, passing grades or not.

Last month, the Federal Reserve did not object to any of the capital plans of 34 banks it reviewed, for the first time in seven years. The news they had all passed their stress tests was widely applauded, but for Bove, that's not a reason to invest in banks.

The stress tests indicated that the banking industry wants to pay out more than 100 percent of its earnings in dividends, Bove, vice president of equity research and financial sector analyst at Rafferty Capital, told CNBC's "Squawk Box."

"Now think about that. If you're going to reduce the capital of a bank at a time when interest rates are rising, you're reducing the present value of the business," Bove said. "So why should I go buy a stock that's reducing the value of its business, reducing the ability to grow its earnings?"

There are "a whole bunch of negative reasons" to avoid bank stocks, including the loan loss provision of the industry, overnight rates and low volume, he said.

"Volume sucks in terms of showing increase of growth in loans anywhere," Bove said.

Jacqueline Reeves, managing director at Bell Rock Capital, was more bullish on bank stocks. Her top picks are PNC Bank and JPMorgan, regardless of whether the Federal Reserve raises interest rates.

"Even if we go forward and continue to move rates higher — which we should see because we're not in a triage mode with respect to the financial space any longer — we should continue to see a breathing room for the banks because they've been pressed against the wall, both on deposit rates as well as lending rates," Reeves said.

David Bahnsen, chief investment officer of The Bahnsen Group, told CNBC he also suggests considering financial stocks. His other top industry to watch is energy.

"We all know the story of technology being a bit played out, and obviously the retail disasters we're seeing played on our screens today," Bahnsen said. "But to us, energy and financials are a great value play."

Federal Reserve Chair Janet Yellen will testify on Capitol Hill this week. It could be Yellen's last time on the Hill if President Donald Trump does not reappoint her when her term expires next February.

Bahnsen said Yellen's testimony could be a "legacy-setting" moment for her and that she may be more likely to surprise investors knowing that her term may be almost over. Regardless of what Yellen says this week, Bahnsen said he expects surprises from the Fed at some point.

"I think they're going to surprise markets later in the year for the first time by actually accelerating that move with the balance sheet, and I think there will be an impact from that," Bahnsen said. "The question is how much the market's already expecting it."