The Trump administration is taking aim at an Obama-era regulation intended to prevent companies from avoiding U.S. taxes by shifting profits out of the country.

The United States is one of the only developed nations that taxes businesses on income earned around the world. That has prompted a growing number of companies to move their headquarters overseas, such as Canadian Tim Horton's acquisition of Burger King. It has also encouraged foreign companies to buy U.S. companies, such as when Belgium's InBev purchased Anheuser-Busch.

President Barack Obama attempted to turn the tide with a raft of sweeping regulations in April 2016. The rules helped scuttle a planned $52 billion deal between drugmaker Abbvie and an Ireland's Shire as well as the $150 billion megamerger between Pfizer and Allergan, also headquartered in Ireland.

Now, the Treasury Department is rethinking one of the most controversial of those rules, one that deals with "earnings stripping." That's when companies load up their U.S. operations with debt and move profits to foreign subsidiaries. Business groups have railed against it as executive overreach with expensive consequences. Under Obama, the Treasury Department estimated it would cost companies $285 million to comply with the regulation, but companies argue that number is too low.

"It is great to see the [Trump] administration recognize the detrimental impact that these regulations will have on America's economic competitiveness," Nancy McLernon, chief executive of the Organization for International Investment, said in a statement.

The White House ordered Treasury this spring to conduct a sweeping review of all tax regulations written during Obama's last calendar year in office. The executive order directed the agency to find rules that were too costly or complex or that overstepped Treasury's authority.

The interim results were made public Friday. Treasury identified eight rules that it said met at least one of the first two criteria, with the earnings stripping regulation the most significant on the list. Treasury said it will propose reforms ranging from streamlining to full repeal by Sept. 18.

McLernon's organization and other influential interest groups, such as the Business Roundtable, have been calling on the White House to delay implementing the earnings stripping rule, which is slated to take effect Jan. 1, or rescind. Her organization said an analysis by PwC found a single Fortune 100 company would likely spend an initial $4 million to comply with the regulation and $1 million each year after that.

"If the regulations are left on the books and enter into full effect, they will increase the complexity of doing business in the United States," trade groups including Business Roundtable said in a letter this spring. "We believe they will frustrate this administration's goals of improving the US business climate, enhancing America's global competitiveness, and driving economic growth and job creation — for all multinational businesses operating in the United States."

The rule requires companies to provide additional documentation when lending money from foreign operations to those based in the United States. Under Obama, Treasury argued that the transactions amounted to transfer of equity — not debt — and therefore were not subject to preferential tax treatment. Business groups said the agency was not authorized to make that distinction.

"A number of these companies would essentially do a bookkeeping transaction," said Mark Mazur, who oversaw the development of the regulations as Treasury's assistant secretary for tax policy under Obama and now directs the Tax Policy Center. "There was no connection to whether that was truly repaid ... or whether the interest rate was close to commercial term."

However, Treasury will not review related rules also proposed in 2016 that were aimed at stopping inversions, in which a smaller, foreign company acquires a larger, U.S. company for tax purposes. Instead, the Trump administration has focused on reforming the tax code, including lower rates for corporations that officials have said would end the incentive for businesses to invert in the first place.

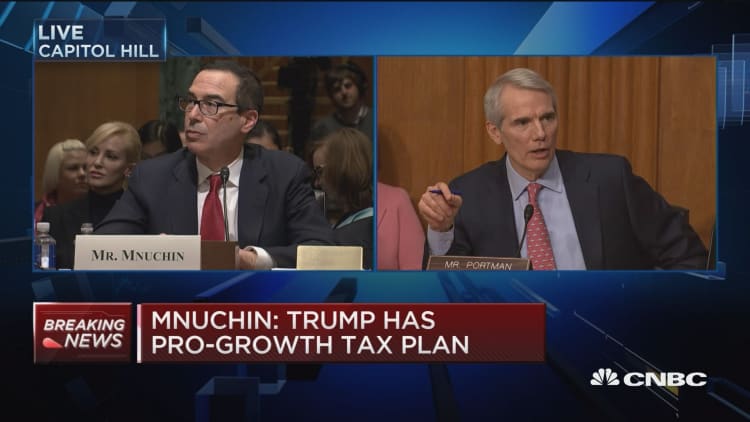

"We're not going to do anything under this administration that inadvertently makes U.S. business less competitive or encourages U.S. business to go abroad," Treasury Secretary Steven Mnuchin said in April, when the review was announced. "We are focused on making U.S. business the most competitive in the world, giving them the tools, and bringing back trillions of dollars."

WATCH: President Trump was bathed in praise at his first cabinet meeting