After Wedbush analyst Michael Pachter reiterated his sell rating of Netflix on Wednesday, Jim Cramer was glad that he at least acknowledged how wrong he has been on the stock.

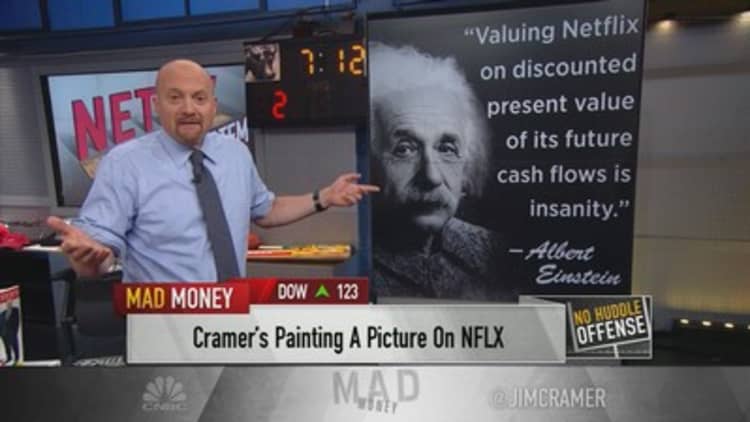

"But I'm also dismayed that he's sticking by his methodology, the same methodology that caused him and his acolytes to miss almost 100 [basis] points in a stock that, to me, is as obvious as the purloined letter," the "Mad Money" host said. "He proudly writes: "We have consistently valued stocks under our coverage based upon the discounted present value of their future cash flows.' Goodie. That bit of ideology reminds me of that quote everybody attributes to Albert Einstein about the definition of insanity: doing the same thing over and over again expecting different results."

Pachter has been bearish on Netflix for about three years, during which time the stock ran from $63.49 to nearly $160.

The analyst justified this using traditional metrics like discounted future cash flows, or how much the money Netflix is set to make in the future is worth now.

Watch the full segment here:

Cramer argued that Netflix, as a company, should not be valued in the same way as others. The streaming giant trades on content metrics and subscriber growth, two very specific and difficult-to-calculate pieces of data.

"You see, at a certain point, the prism you're using is just wrong, and you've got to to scramble. You have to adapt. You've got to find a new one," Cramer said. "I don't mean to pick on Pachter, although I think 'Pick on Pachter' would be a great name for a sit-com, but periodically, there are stocks that defy the traditional metrics and you've just got to scrap those metrics if you want to understand the stock."

In his analysis, Pachter writes that an increase in show cancellations and poor execution of expensive originals could pose threats to Netflix's hefty $6 billion content budget for 2017.

While cancellations could set Netflix back, especially since its budget far outpaces what its competitors plan to spend this year, Cramer said that more content naturally results in more cancellations.

"Given all the original content Netflix puts out, the failures are somewhat inevitable, and if anything, they'll have to increase. That's the law of large content," Cramer said. "Still, the record is darned good, much better than everyone else, and that matters, especially when worldwide numbers are at stake and some content plays extraordinarily well overseas."

Along with the stocks of Amazon and Tesla, Netflix's big picture cannot be captured by using traditional methods of valuing stocks, which is where Pachter went wrong, Cramer said.

"Knowing the right metric has always been the key to picking good stocks," Cramer said. "Wedbush has clearly picked the wrong metric. And sometimes, that's all that matters."

In an email to CNBC, Pachter responded to Cramer's analysis:

"Jim is absolutely right that my Sell rating is based on the wrong metrics," the analyst wrote. "Investors care about subscriber additions, and as long as they continue to care about subscriber additions and those metrics rise, the stock will continue to work."

Pachter noted that having covered the stock of Netflix for 13 years, he has only miscalculated the number of subscriber additions for two out of 52 quarters.

"I am not so arrogant (or foolish) as to believe that investors care what my rating or price target is; rather, they care about my view on the metrics that matter, and as stated above, I have nailed subscriber additions correctly 95% of the time. If that's the metric that matters, I've done my job," Pachter wrote.

Pachter went on to write that as a sell-side analyst for Wedbush, it is his job to issue price targets and ratings on stocks for investors.

"In the upcoming quarter (Q2, reporting Monday after the close), my call is that they are going to crush both domestic and international subscriber net additions," Pachter said in the email. "That's all investors care about. ... I talk about Netflix a lot (literally every day) to investors, and have consistently said that so long as people care about subscriber additions, the company will deliver and the stock should be owned."

Where Pachter disagreed with Cramer was on using subscriber additions as a solid metric for estimating future cash flows. The analyst argued that while more subscribers will likely lead to revenue growth, it will not lead to strong operating leverage for Netflix.

Pachter wrote that this will be true as long as most of the content watched on Netflix is owned by third parties. He pointed out that Netflix does not own most of its branded "originals" like "House of Cards" and "Orange is the New Black," its two top shows.

"Investors have bought into the fiction that they own every 'original', yet they own fewer than 20% of them. In order to be compared favorably to HBO (which is worth around 20% of what Netflix is worth), they need a lot more success with OWNED originals," Pachter wrote. "That's the basis for my cash flow argument, and I don't really care how many subscribers they add, they are not even remotely close to making real profits."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com