Stifel upgraded Snpachat-parent Snap shares to buy from hold on Thursday a day after the stock hit a new low since its March IPO.

Analyst Scott Devitt said in a note Thursday that some of the worries surrounding Snap could be overblown:

Competition from Instagram remains a chief concern for investors, though recent app download trends appear healthy in key ad markets, leading us to believe near-term risks to revenue-generating [daily active users] may be overstated. Despite concerns in the market and persistent comparisons to Twitter, we believe Snap's business remains on track fundamentally as it continues to develop innovative consumer products and increasingly sophisticated tools for advertisers.

Shares of the social media firm jumped 2.9 percent to $15.69 following the upgrade. The stock hit a record low of $15.21 on Wednesday, well below its initial public offering price of $17. On Monday, it closed below the IPO price for the first time.

The stock, which has fallen for the past eight sessions, has also been hit on fears of impending massive insider selling when at least an estimated 950 million shares in the recent IPO become available for sale later this month.

"As more and more internet companies have gone public over the past five, six, seven years, investors have become more educated on timing and pricing in the incremental supply," Devitt told CNBC's "Fast Money: Halftime Report" on Thursday. "Snap has been responding to the upcoming lock-up expiration for some time now."

User retention and growth have been big concerns for investors regarding Snap, especially with social media giant Facebook putting more pressure on the firm.

In May, Facebook CEO Mark Zuckerberg told analysts that Instagram Stories had 200 million daily active users. By comparison, Snap had 161 million daily active users at the end of last year.

Stifel is now one of the minority of Wall Street firms with a positive outlook on Snap.

Seventeen analysts rate the stock a hold or sell vs. 12 who now rate it a buy, according to Tipranks.com, an overwhelmingly negative viewpoint for a company just four months after its IPO. Even one of its underwriters, Morgan Stanley, downgraded the stock this week.

Disclosure: CNBC parent NBCUniversal is an investor in Snap.

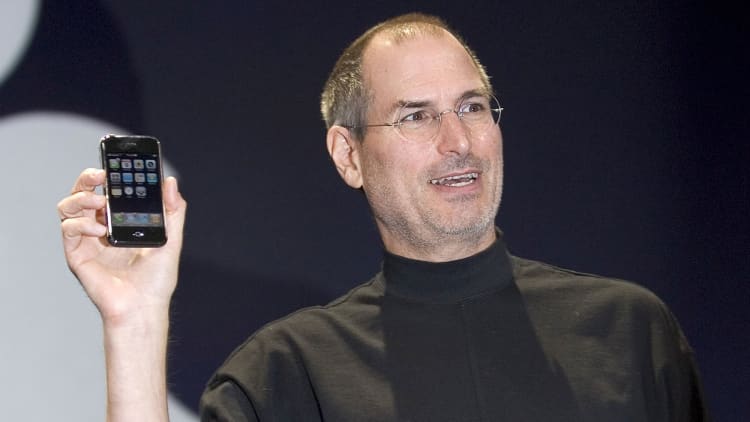

WATCH: Using the original iPhone really made us appreciate our iPhone 7