The most simple and reliable chart pattern out there is one that Jim Cramer dreads.

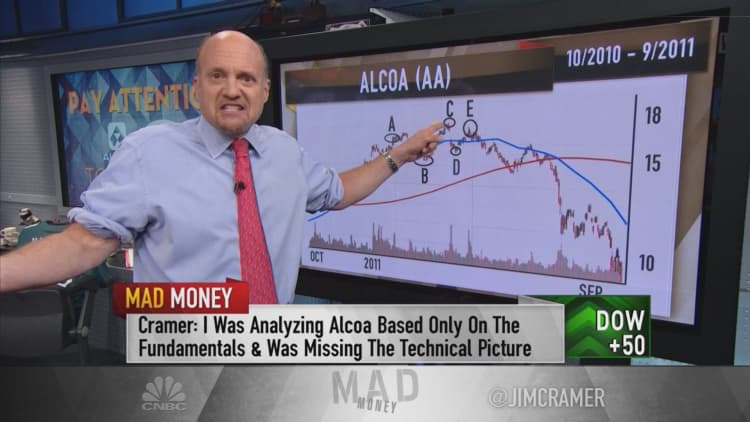

Unfortunately, Cramer learned not to ignore the head-and-shoulders pattern the hard way. His charitable trust bought Alcoa — which spun off its aluminum business in November 2016 under the name Alcoa and is now known as Arconic — in 2010, when the stock price was in the low teens and ultimately took a loss because it was too early to buy.

"Yes, just like a human's head. That is the most frightening pattern in the chart book," the "Mad Money" host said.

Shares of Alcoa saw a healthy run from the winter of 2010 to February 2011, rising from $13 to $17. The stock ran to $18 on the eve of its quarterly earnings report, and Cramer thought it was a fine quarter when it reported.

What worried him was that even after an initial positive reaction, the stock dropped. Several days later, however, Cramer assumed it would take out its $18 level and went back to buy more.

But Cramer was wrong — extremely wrong.

What the "Mad Money" host did not realize is that the fluctuation in price had traced a perfect head-and-shoulders pattern.

It turns out that during the time when the head-and-shoulders pattern was forming on Alcoa's chart, Europe and China's markets started to slow down, sending aluminum into a glut.

Ultimately, former CEO Klaus Kleinfeld could control his own company but not the price of the commodity itself.

On the other hand, if a head-and-shoulders pattern signals trouble ahead, then the inverse head-and-shoulders formation signals the opposite — a chance for glory.

"The key with this pattern is the neckline, the line that connects the high to the two shoulders. When a stock breaks out above that line it tells a technician that you are about to witness a big move higher," Cramer said.

At the end of the day, patterns matter. So when you see a head-and-shoulders pattern, no matter how confident in the stock you might be, Cramer believes you should sell. And when the reverse head-and-shoulders develops, then you should consider buying.

That is just how powerful these moves are. The chart is right more often than most would ever think possible.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com