Despite a flood of analyst upgrades on Wall Street, Snap shares fell 5 percent this week. And two upcoming events could send the stock to fresh lows.

The social media company has already tanked 44 percent since its March 2 IPO, and with the stock's lockup period expiring over the weekend and Q2 earnings to follow on August 10, the options market is implying some big moves for the stock.

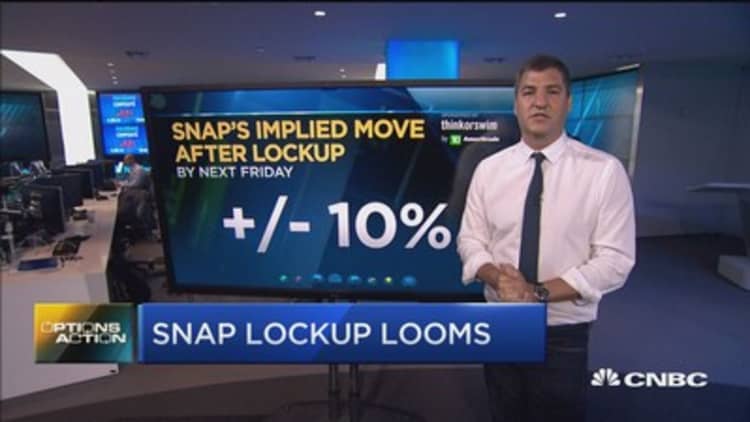

Traders expect Snap to move 10 percent in either direction by next Friday's close following the lockup expiration. This means that Snap does have the potential to bounce back above $15 from Friday's levels.

But an even bigger implied move of 16 percent in either direction is expected from Snap's earnings. When Snap reported its first earnings on May 10, the stock tanked 25 percent in the after-hours session. A 16 percent implied move could mean that Snap falls below $12.

However, Dan Nathan of RiskReversal.com said Thursday's move in Snap was "pretty interesting" and that a "short squeeze" might have been in play. This is because Snap shares seemed to have bottomed on Thursday but then reversed, leading Nathan to believe that short sellers may have closed out their positions in Snap.

"People are expecting a lot of downside volatility, and sentiment is horrible," said Nathan Thursday on CNBC's "Fast Money." "So to me, this thing could go the other way next week if investors choose not to sell."

Snap shares were down 2 percent on Friday.