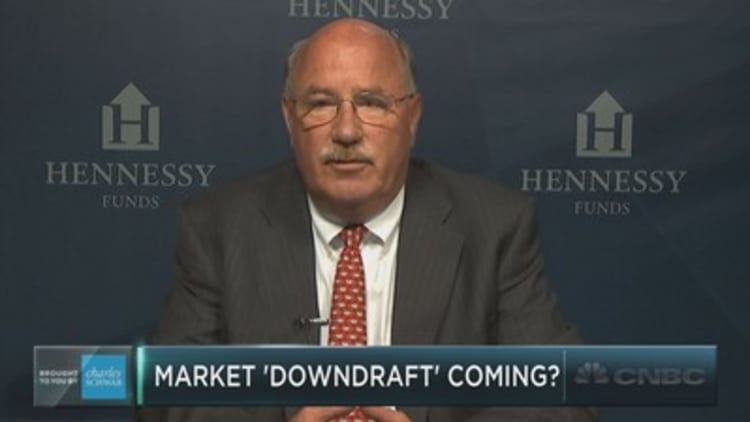

Money manager Neil Hennessy believes a problematic trend is gripping the markets, and it could drag stocks down by 5 to 10 percent at any time.

"What the investors are now going into is passive investing. They're going into these index ETFs. And, the indexes, BlackRock and Vanguard and you name it, they all own the same companies in the same percentage. If something should scare the investor and they want to sell, everybody is going to have to sell at the same time. They're going to be selling the same stocks," Hennessy, chief investment officer at Hennessy Funds, said Monday on "Trading Nation."

"You gotta be prepared so you don't get — for lack of a better word — freaked out," he added.

Hennessy, whose firm has $6.6 billion in assets under management, is an active money manager. His funds include the Hennessy Focus Investor Fund and Hennessy Total Return Fund.

"What the public and investors now believe the concept is the lowest fees are the best thing for the best returns. And, that's so far from the truth," said Hennessy.

Despite his call for a "severe" downdraft, Hennessy believes active managers like himself are best positioned to weather the storm.

"So the active manager, when we have this downdraft, will be able to buy some very, very good companies at very cheap prices," said Hennessy, who's a secular bull and estimates the pullback would last just a week or two.

Vanguard spokesperson Freddy Martino in a statement to CNBC in response to Hennessy's comments said: "We believe fears that indexing is driving the market are overblown. Indexing spans most regions and asset classes, not just large-cap U.S. equities, and accounts for 15 percent of the global equity market's capitalization and 5-10 percent of daily trading volume."

BlackRock declined to comment.

CNBC's finance editor, Jeff Cox, reported earlier this year that investors bailed on actively managed funds in record numbers in 2016, hoping to take advantage of the low costs and reliability associated with index funds.

The move came after one of the worst years ever for stock pickers. Just 19 percent of active managers beat the large-cap Russell 1000, according to Bank of America Merrill Lynch.

Hennessy declined the opportunity to respond to Vanguard.