Ever since the financial crisis, U.S. stocks have smoked international stocks, leading to a dangerous risk that your portfolio is suffering from "recency bias."

That's the behavioral tic that leads us to presume that whatever has been happening of late will just continue in the future. And right now that makes taking some profits in U.S. stocks and rebalancing your portfolio back into the laggards — a hard move to pull the trigger on.

Fidelity reports that investors have decreased their international stock stakes since 2009, and on average have less than 20 percent invested outside the United States.

The last three or four years have been harder to convince clients on international investing given how well the U.S. has done, said Anthony LoCascio, a certified financial planner in Clinton, New Jersey.

"But it is not prudent to suggest it will just continue this way," he added. "If you're looking for where the next gains are, Europe and emerging markets certainly offer opportunity."

The fact that international equity markets have underperformed for so long is all the more reason to not give up on them now.

There's no schedule for when reversion to the mean kicks in, but you'd have to be a card-carrying member of the "this time is different" investing club to think that large-cap U.S. stocks, currently trading at nearly 30 times long-term earnings, are capable of strong returns, let along global leadership over the next 10 years.

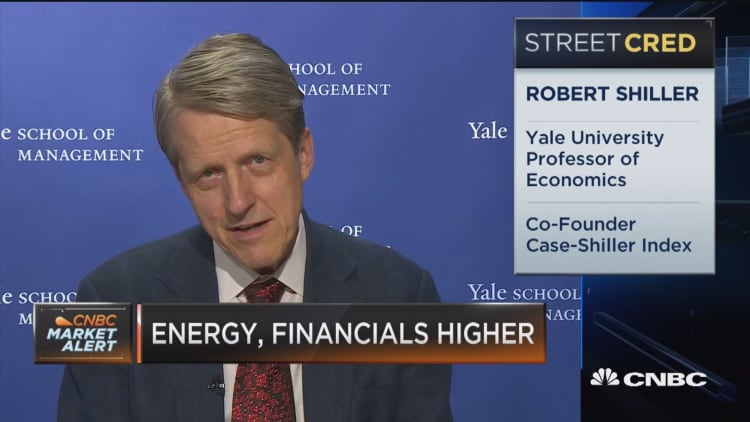

That near-30 of the Shiller PE, a popular valuation measure, is almost double the long-term median of 16.1. By comparison, the stocks from developed international markets included in the MSCI EAFE index trade at 16 times their long-term earnings, which is well below their 25 times historic median.

Research Affiliates, which shares its number crunching in a free online tool, estimates that the annualized real return for U.S. stocks over the next 10 years will be less than 1 percent, compared with 4.8 percent for the EAFE index. More volatile emerging markets are estimated to pack even more opportunity, with an annualized inflation-adjusted return of 6.8 percent.

"Instead of asking yourself why you should invest in international equities, the better question is why you aren't investing more in international stocks," said Gregg Fisher, founder of the Gerstein Fisher investment advisory firm.

The Gerstein Fisher Multi-Factor International Growth Equity Fund has gained an annualized 10.6 percent the past five years, outpacing an index of international stocks by more than 4 percentage points.

Fisher notes that while U.S. stocks represent about half of the market capitalization of global publicly traded stocks, and about 25 percent of world gross domestic product, U.S. investors have a home bias that leads them to typically keep 70 percent to 80 percent or more of their stock portfolio invested in the U.S.

For the record, Vanguard suggests that at least 40 percent of a stock portfolio be invested outside the U.S.

Instead of asking yourself why you should invest in international equities, the better question is why you aren't investing more in international stocks.Gregg Fisherfounder, Gerstein Fisher investment advisory firm.

"Ask yourself what is the probability that the U.S. will be the best market 10 years from today. Unless you think there is a 100 percent probability, you should be rethinking your investment in international," Fisher said.

He also believes that the growing protectionist rumblings in the U.S. and elsewhere is another reason to maintain international exposure beyond current market fundamentals.

"It could lead to a situation where we have less correlated markets. Interest rates may be less correlated. The trade environment may become less correlated. Inflation may be less correlated. Currency could become less correlated," Fisher said.

"We don't know how this going to play out over the next 10 years, but diversification is a way to address the possibility of a less correlated world."