Gasoline prices surged over the last two days as Hurricane Harvey headed toward the U.S. Gulf Coast refining hub, but analysts warned that the price difference against crude oil could come crashing back down next week.

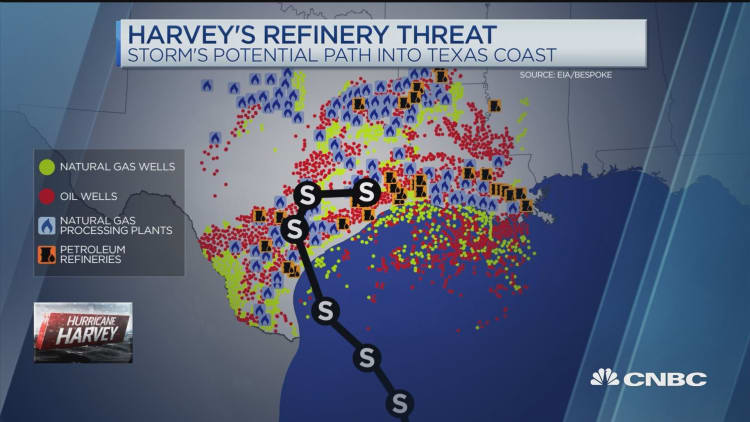

The weather event is pushing up gasoline prices because a number of refineries have shut down. Flooding threatens to damage the facilities on the Gulf Coast, which is home to nearly half of U.S. refining capacity. It's pushing oil prices lower because it reduces refinery demand for crude oil, the raw material used to make gasoline.

The difference in the price of crude oil for October delivery and Nymex gasoline futures for September — what the oil industry and futures traders call the "crack spread" — blew out to about $24 on Friday, almost double recent levels.

Gasoline futures rose nearly 3 percent on Thursday, while West Texas Intermediate crude, the U.S. benchmark, tumbled 2 percent.

In trading Friday afternoon, the U.S. gasoline price for deliveries in mid-September declined fractionally. West Texas Intermediate crude recovered to trade up about a half a percent at $47.63.

"It's a gasoline story more than a crude oil story at the moment," Ed Morse, Citi's global head of commodities research, told CNBC's "Squawk on the Street" on Friday.

Gulf Coast gasoline for spot delivery was at $1.73 per gallon, up 23 cents from Tuesday, according to Oil Price Information Service. Nymex gasoline was up about 5 cents over the same period.

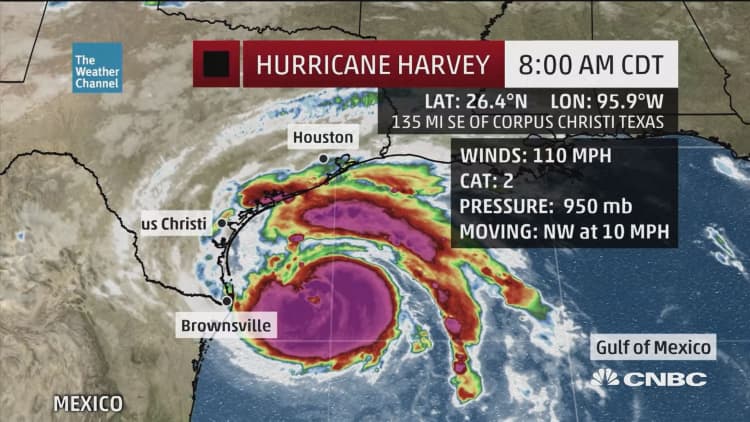

The National Hurricane Center upgraded Harvey to a Category 2 hurricane on Friday, raising concerns that heavy flooding could affect refiners for weeks, rather than days. Harvey could dump as much as 35 inches of rain on parts of Texas.

The central question for refineries and traders is how long the storm stalls over areas like Corpus Christi, Houston and Galveston, said Andy Lipow, president of Lipow Oil Associates.

"If we get rapid accumulation in 24 hours the refineries simply can't pump the water fast enough out of the location," he told CNBC's "Squawk Box." That could lead to damage to electric pumps in refineries, potentially requiring repairs that could take weeks or months, he added.

As the consensus estimate begins forming around a weeks-long outage, the picture for crude demand just becomes worse and worse, said John Kilduff, founding partner at energy hedge fund Again Capital.

The crack spread is almost double recent levels, but rising gasoline prices tend to stabilize declines in crude oil prices and eventually pull them higher, according to Kilduff.

"The crack spread can only widen so far," Kilduff said.

"If this [hurricane] is a goner come Monday, all these gains are a goner come Monday too," he added.

The crack spread should continue to rally, with gasoline rising and crude remaining under pressure, if any flooding at refineries causes prolonged delays in bringing the facilities back online, said Stephen Schork, editor of the Schork Report.

"That said, if we go through and we don't see any lasting damage, and these refineries, which have shut in in an orderly manner, come back online quickly, then these cracks, the differential between gasoline prices and crude oil prices, which are sky high right now, will come crashing back down," he told CNBC's "Squawk on the Street" on Friday.

— CNBC's Patti Domm contributed reporting to this story.

WATCH: Harvey presents bull & bear case for oil