Gasoline futures prices soared to a more than two-year high Monday after Tropical Storm Harvey caused severe flooding along parts of the Texas Gulf Coast, a major refining hub.

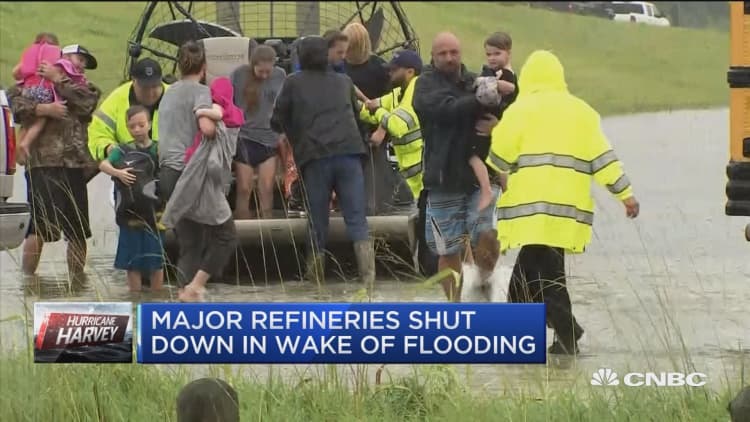

Several refineries in the area shut down before Harvey made landfall as a hurricane on Friday, while ports in the area were closed to all incoming and outgoing traffic. Analysts expressed concern that workers will not be able to access the facilities in the coming days because of flooding in Houston and other areas.

The U.S. Gulf Coast is home to nearly half of U.S. refining capacity.

Benchmark gasoline futures rose to a session peak of $1.7799 per gallon, the highest level since late July 2015, as the refinery outages threatened to create a short-term undersupply of the fuel. Meanwhile, U.S. crude oil prices fell, reflecting lower demand for the raw material at shuttered refineries in the coming days.

U.S. gasoline futures for September delivery were trading about 3 percent higher at $1.7157 a gallon by 10:40 a.m. ET (1440 GMT).

So far, there are few reports of damage to refineries, but the rising gasoline futures price indicates that the market is worried that workers will not be able to reach the facilities, said John Kilduff, founding partner at energy hedge fund Again Capital. The refineries are likely to remain closed throughout the week, he said.

The effect on gas prices "could be a sort of slow but steady climb that all of a sudden becomes eye popping," he told CNBC's "Squawk Box" on Monday.

Spot prices for Gulf Coast gasoline contracts are about 30 cents higher than they were a week ago, said Tom Kloza, global head of energy analysis at Oil Price Information Service. However, contract trading is very subdued because traders in Houston cannot access their offices, he said.

The extent of damage to refineries in the Houston area — which is unclear at present — will play a major part in determining price swings in the coming days, according to Kloza.

"I'm very, very worried about Houston, Beaumont, Bay City, the triangle where so much refining is located. It's hard to forecast because, as I say, it's unprecedented and the outcomes are completely unknown," he told CNBC's "Squawk Box" on Monday.

Nationally, the average price of gasoline at the pump was at $2.368, up slightly from a week ago, according to AAA.

The Colonial Pipeline, which brings gasoline from the Gulf Coast to the Southeast and Northeast U.S. was still operating Monday. The U.S. is well supplied with gasoline stockpiles.

"The short answer is that gas prices are going higher. They're going higher at an annoying rate, not an apocalyptic rate, but it will be noticeable, particularly east of the Rockies in the next few days," Kloza said.

The good news for consumers is that refineries are preparing to switch to winter gasoline blends, which are more plentiful and easier to make, said Kilduff. That should give consumers a break at the pump.

The storm is bearish for oil prices because refineries will not be able to operate at the high run rates seen in July and August, reducing demand for crude, according to Kloza.

U.S. West Texas Intermediate oil futures were down $1.19, or 2.5 percent, at $46.68.

— CNBC's Brian Sullivan contributed reporting.

WATCH: Looking at 'mini-gasoline spike' after Harvey: Tom Kloza