Odds are falling that Republicans can achieve their last best hope of a 2017 policy breakthrough with major tax reform, for three reasons.

The first is a darkening broader political landscape.

White House officials like to note that it's been three decades since Washington last passed comprehensive tax reform legislation. That's because ideological, legislative, lobbying and public opinion pressures are so strong that it requires political cards to fall just right. In 1986, when a popular president (Ronald Reagan) cooperated with both parties on overlapping policy goals, they did.

President Donald Trump, however, is not popular, and he hasn't yet specified his policy goals except to scuttle the revenue-raising portion of the House GOP plan that makes deep rate cuts possible. Now the congressional agenda for the remaining four months of the year is crowded with new obligations, including hurricane recovery assistance, immigration, and an Obamacare fix as well as longer-term budget and debt-limit deals.

The second reason is rising deficit pressures.

Genuine tax reform is hard, requiring elimination of valuable benefits for some interests in the name of fairness and efficiency without cutting overall revenue. An easier fallback, which Mr. Trump has signaled that he values most of all, is simply cutting rates within the existing system and allowing deficits to rise.

Many Republican lawmakers don't mind tax-cuts that increase deficits, reasoning they will stimulate faster growth. But some do mind, and it only takes a few defections from a 52-member Senate GOP majority to block action.

Now Republican deficit hawks face the prospect of large new outlays for Harvey and Irma. In return for going along with new GOP defense spending hikes, Democrats will also insist on boosting non-defense spending in any long-term budget deal with the White House.

The third reason is rising discord within the GOP.

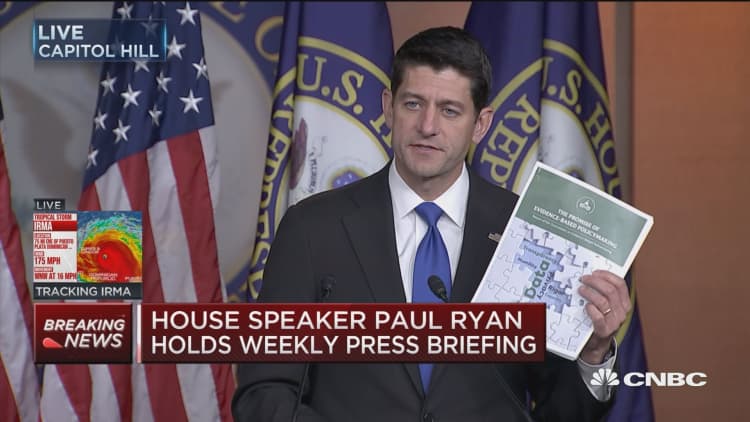

Republicans aim to pass tax reform under special budget rules that wouldn't require any Democratic votes. But Mr. Trump, having insulted top Republicans for their earlier failure on health care, undercut House Speaker Paul Ryan and Senate Leader Mitch McConnell on their first post-Labor Day initiative by siding with Democrats Nancy Pelosi and Charles Schumer on a short-term spending, debt limit, and Harvey relief deal.

Hard-right activists outside Congress, such as Heritage Action, are strongly opposing that deal in the House even after it passed the Senate. They are likely to fail, in part because Republicans in Harvey-ravaged Texas have no choice but to acquiesce, as Sen. Ted Cruz did.

But those outside activists now have a potent and well-informed new weapon. Steve Bannon, the self-styled "street fighter" who had served as Mr. Trump's chief strategist, quit to rejoin Breitbart News.

In a new interview with CBS, Bannon called for the resignation of his old White House rival Gary Cohn. Cohn, the former Goldman Sachs executive who now directs the National Economic Council, is a principal architect of Trump's attempt to pass tax reform.

One senior White House official told me that Congress still can manage to put major tax reform legislation on Trump's desk before the clock runs out on this week's short-term debt and budget deal in December. Other Republicans see final action in the first quarter of 2018 at the earliest.

With all the diversions and divisions, the strongest propellant for action on taxes remains alarm over next year's congressional elections. GOP strategists already fear that 2018 could be the fourth consecutive midterm election in which unhappy voters change control of at least one chamber of Congress.

"Republicans cannot afford to fail to pass something they can call tax reform," said former GOP Rep. Jim McCrery, once a senior member of the tax-writing committee.

That's the same factor GOP strategists had said would assure repeal-and-replacement of Obamacare. It wasn't enough.

WATCH: Start tax reform by 'doing no harm'