In late February, early March, a debate developed concerning what factors actually drive bank stock prices. The vast majority in that debate argued that an increase in interest rates, positive stress tests, high levels of stock buybacks, easing banking regulations, and a strong bull market would continue to drive bank stock prices higher.

On the other side, a very small minority, including myself, argued forcefully that these factors were not the key to bank stock prices. The rally in these issues was over. The key would be the sale of high quality products. Translating this means that banks needed to sell more loans and those loans could not go bad.

Both sides in this argument obtained what they wanted. Every promise the bulls made about banking came true. My assumptions also came true. Loan volume continued to weaken and loan quality began to deteriorate.

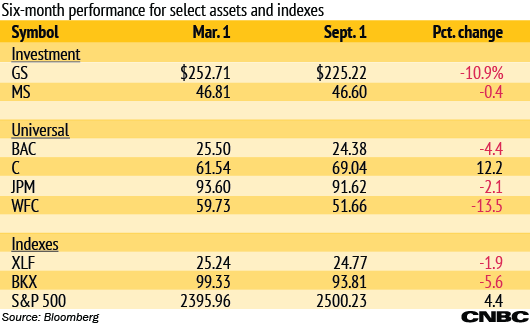

The market made its judgment. Five of the six largest bank stocks fell in price from March 1 to the present. The XLF which monitors the price action of big financial institutions is down slightly or 1.9 percent. The KBW Nasdaq Bank Index, BKX which is a large index covering many more bank stocks, is down somewhat more or 5.6 percent. The S&P 500 is up 4.4 percent. The broader bank index has under performed the market by 10.0 percent.

So why were the banking bulls, to this point, so wrong?

Start with their view on interest rates; it simply made no sense. They argued that banks cannot make money when interest rates are low for long periods and that bank interest rate margins would be up sharply if the Fed raised rates. Yet from 2010 to 2016, interest rates were the lowest in recorded history and bank earnings went up in all but one of those years. Bank profits were at all-time record levels in 2013, 2015 and 2016.