Oil prices slipped after Brent crude hit a 26-month high during a rally fueled by Turkey's threat to cut crude exports from Iraq's Kurdistan region as well as signs that market rebalancing is accelerating.

Brent crude futures fell 79 cents, or 1.3 percent, to $58.23 a barrel by 2:24 p.m. ET (1824 GMT), having earlier hit $59.49, the highest since July 2015 and more than 34 percent above the 2017 low.

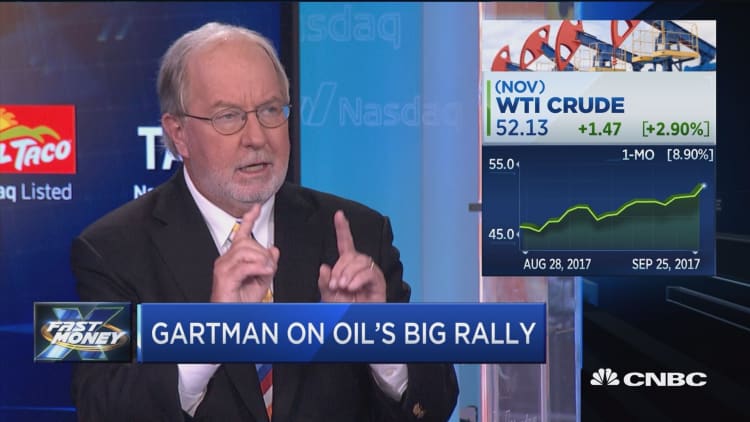

U.S. crude WTI futures ended Tuesday's trade down 34 cents at $51.88 a barrel, after hitting a five-month high of $52.43 a barrel.

Turkish President Tayyip Erdogan threatened on Monday to cut off the pipeline that carries 500,000-600,000 barrels of crude per day from northern Iraq to the Turkish port of Ceyhan, intensifying pressure on the Kurdish autonomous region over its independence referendum.

This potential loss, combined with 1.8 million bpd of output reductions by the Organization of the Petroleum Exporting Countries and non-OPEC producers, has raised concerns of tighter supply.

The Iraqi government said it will not hold talks with the Kurdistan Regional Government about the results of the referendum, which is expected to show a comfortable majority in favour of independence after the results are announced later this week.

"Although there was plenty of price-bullish news making headlines yesterday, undoubtedly the biggest factor was the referendum in the Kurdistan region of Iraq," analysts at Vienna-based JBC Energy said in a note.

The rally over the past two days led to profit-taking.

"The market was approaching if not in overbought territory," Robert Yawger, director of energy futures at Mizuho Americas.

"We prefer to take a pause at $60.00 a barrel (for) Brent," Petromatrix strategist Olivier Jakob wrote in a note.

Top oil executives gathered at the S&P Global Platts APPEC conference in Singapore said strong oil demand this year was accelerating market rebalancing and helping inventory drawdowns.

"Global demand growth is way higher than what we have observed in the last couple of years, coming somewhere close to 1.6 to 1.7 million barrels per day and is driven by distillates", said Janet Kong, BP's chief executive officer, supply and trading, Eastern Hemisphere.

OPEC and non-OPEC producers meeting in Vienna last week said the market was well on its way towards rebalancing.

However, other analysts were sceptical about further price gains due to higher oil output from the United States.

The U.S. Energy Information Administration said that production from wells in shale formations will rise for a 10th month in a row in October.

U.S. shale producers' ability to ramp up output as later-dated crude prices strengthen will keep price volatility low, said Jeffrey Currie, Goldman Sachs' head of global commodities research.