Crude is on pace for its best month since April 2016, and one Wells Fargo strategist says there's still room to run in the crude rally.

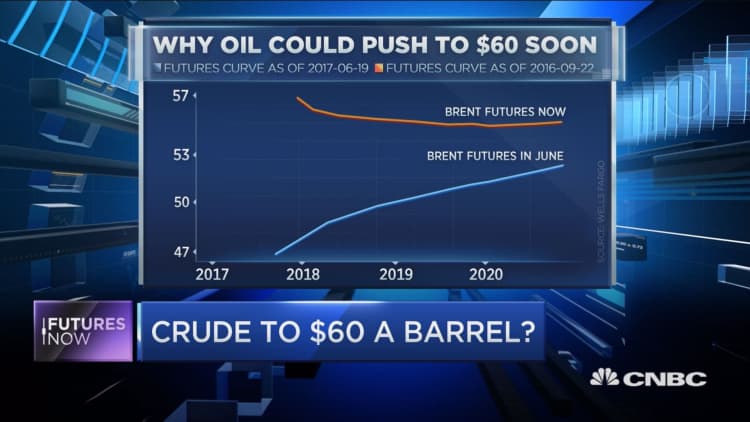

Scott Wren, a senior global equity strategist at Wells Fargo Investment Institute, says that a "backwardation" has appeared in the oil futures that could take oil up to $60, which it hasn't hit since July 2015. A backwardation occurs when futures contracts expiring at later dates are trading lower than current prices, which according to Wren is being seen now in oil.

This, Wren says, means there is less of an incentive to store oil into the future and hedge against it, which usually leads to higher oil prices in the short-term.

"It's a backwardation setup right now rather than the regular contango kind of formation," he explained Tuesday on CNBC's "Futures Now." "And so people are buying oil in the front months."

But this momentum can only reach a certain point, says the strategist. Wren expects rig counts to rise in the coming months along with production, thereby increasing the supply of oil versus demand. This increase in supply versus demand, says Wren, could send oil prices back to $40 by year-end.

Anthony Grisanti, founder of GRZ Energy, believes that $52.30 to $52.60 is the "next level of resistance" for oil given that he sees demand for oil dropping in October.

Based on Tuesday's levels, when crude oil was just 10 cents away from $52, Grisanti sees oil making a downturn soon.

As of Tuesday afternoon, crude was on track to break a 4-day winning streak.