Global oil prices fell on Wednesday while U.S. crude rallied, after crude stockpiles unexpectedly drew with refiners coming back online following Hurricane Harvey last month.

U.S. crude for November delivery ended Wednesday's session up 26 cents at $52.14, but stayed below five-month highs.

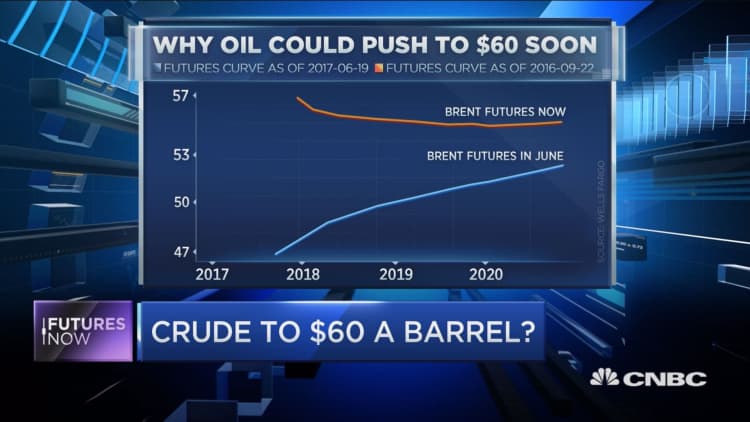

Brent crude futures were down 68 cents, or 1.2 percent, at $57.76 a barrel by 1:38 p.m. ET (1838 GMT), slipping from 26-month highs.

Both benchmarks remained on track for monthly gains on stronger demand as refiners along the U.S. Gulf Coast ramped up production after Harvey crippled capacity.

U.S. crude inventories fell by 1.8 million barrels in the week to Sept. 22, the U.S. Energy Department said. Analysts had forecast an increase of 3.4 million barrels.

The crude draw supported oil prices, but gasoline stocks surprisingly rose and stocks of distillates were down by less than anticipated. U.S. gasoline stocks rose by 1.1 million barrels, compared with analysts' expectations in a Reuters poll for a 921,000-barrel drop.

Wholesale U.S. gasoline prices were down 2.5 percent at $1.6571 per gallon.

Refinery utilization rates rose by 5.4 percentage points, as most facilities have come back online following Harvey.

The effects of that storm, as well as Hurricane Irma, which struck Florida earlier this month, may dampen demand for some time, potentially increasing gasoline inventories while crude stocks are drawn down thanks to renewed refining activity.

Traders and analysts said a report from pricing agency Platts that a force majeure on exports of Bonny Light crude, scheduled to be 161,000 barrels per day (bpd) this month, could be lifted "very soon" was behind the loss in Brent.

Turkey's repeated threat to cut oil exports from the Kurdistan region in northern Iraq pushed the price of Brent close to $60 a barrel on Monday for the first time since June 2015.

"All the ingredients are now there for a flare-up in regional tensions with Iran also weighing in on the matter," PVM Oil Associates analyst Tamas Varga said.

Brent futures are commanding their highest premium over U.S. crude in more than two years, partly because of the quick production response by U.S. shale producers to any uptick in price.

U.S. production rose to 9.55 million barrels a day in the most recent week, though those weekly production figures are subject to large revisions. Exports also increased, hitting a weekly record of 1.5 million barrels a day.

"Seeing exports of U.S. produced crude that large would pose a threat to the level that the Brent-WTI premium can go," said Gene McGillian, manager of market research at Tradition Energy in Stamford, Connecticut.

A rise in the dollar to one-month highs against the euro following a signal the previous day by the head of the U.S. Federal Reserve that rates will continue to tighten dampened the broader commodity markets.

A stronger dollar often results in weaker oil prices, as non-U.S. investors find it more profitable to sell assets priced in the U.S. currency.

— CNBC's Tom DiChristopher contributed to this report.