Republicans have powerful incentives to produce on tax reform. Donors want a return on their investment, voters want their team to win, and leaders want to keep their majorities.

Yet they also face big obstacles. Just as they've failed to repeal and replace Obamacare, Republicans could fumble on taxes despite controlling both the White House and Congress.

Here are some major reasons for doubt:

Fairness

The outline released by the White House and congressional leaders would raise the lowest tax rate on individuals (from 10 percent to 12 percent) but reduce the top rate on wealthy individuals (from 39.6 percent to 35 percent) and corporations (from 35 percent to 20 percent).

The outline provides offsetting benefits for those of modest incomes, such as increasing the standard deduction. It opens the possibility of unspecified additional tax hikes on the wealthy. Gaps in detail make comparing different income groups impossible.

But polls show most Americans prefer higher taxes on the rich and corporations. So far, the plan gives opponents some big, fat targets.

Credibility gap

The health-care debate exposed contradictions between GOP promises to cut costs and the reality that their proposals would leave millions fewer Americans with health insurance. Republicans have the same vulnerability on tax reform.

President Donald Trump insists middle-class Americans, but not the wealthy, will benefit. That's not true. Not only does the plan propose a top rate cut, it would eliminate the alternative minimum tax as well as the estate tax — which applies only to multimillion dollar inheritances.

Administration officials insist their plan will not increase federal deficits. That's not true, either. Senate Republicans have acknowledged as much by preparing a budget resolution allowing $1.5 trillion in tax cuts that would increase deficits.

Different circumstances

Republicans cite benefits from earlier tax cuts, most notably under President Ronald Reagan. But conditions have changed.

Reagan's 1981 tax cut lowered the top rate from 70 percent to 50 percent. Today's 39.6 percent top rate leaves less room to spur economic activity by reducing it.

President George W. Bush's 2001 tax cut helped stimulate an economy in recession. Today's economy is growing, with strong corporate profits. That 2001 tax cut also came with the federal budget in surplus. It's in deficit today.

GOP discord

GOP leaders will pursue tax reform under special budget "reconciliation" rules preventing a Senate Democratic filibuster. But that requires two things that won't be easy: passing a budget and keeping at least 50 of 52 Senate Republicans united behind the tax plan.

Republican moderates such as Sens. Susan Collins and Lisa Murkowski, who helped sink Obamacare repeal plans, will scrutinize the tax proposal as well on fairness and fiscal-responsibility grounds. And the populist insurgency that rattled GOP leaders in this week's Alabama Senate runoff adds another wild card.

Before resigning as Trump's White House strategist, Steve Bannon argued unsuccessfully for raising the top rate on wealthy Americans to 44 percent. Now back at Breitbart News, Bannon vows to battle more "establishment" Republicans on behalf of blue-collar voters as he did in boosting Roy Moore's defeat of Alabama Sen. Luther Strange.

Bannon-allied primary challengers to other GOP incumbents could affect the Senate debate by pressing for a higher top rate. That in turn could roil the House, where Speaker Paul Ryan has staunchly favored lowering marginal rates.

Time

The tax effort is already behind schedule, which initially called for enactment by August. By this time in 1981 and 2001, the Reagan and Bush tax cuts had been signed into law.

GOP leaders say they will hope to have tax reform on Trump's desk before year's end. Yet this week's nine-page outline only partly filled in blanks left by the administration's one-page outline five months earlier.

Lacking consensus on details, Trump aides say House and Senate committees can resolve them. But intense lobbying by affected interests means disagreements won't be resolved quickly or easily.

Looming 2018 midterm election pressures increase the degree of difficulty. That's why it's been three decades since Washington last succeeded on comprehensive tax reform.

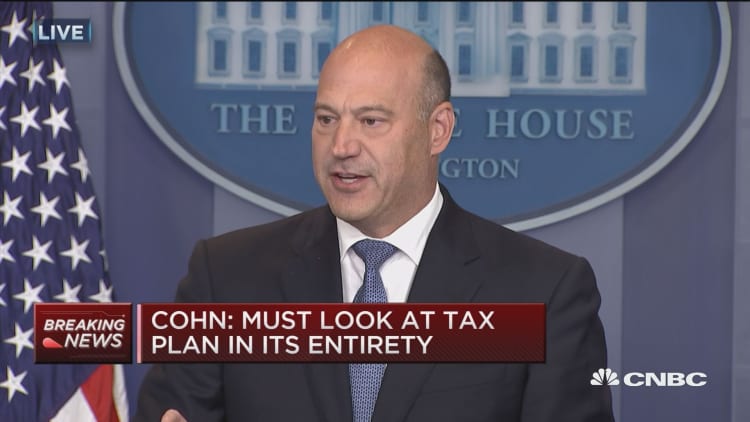

WATCH: Cohn's comments on tax reform