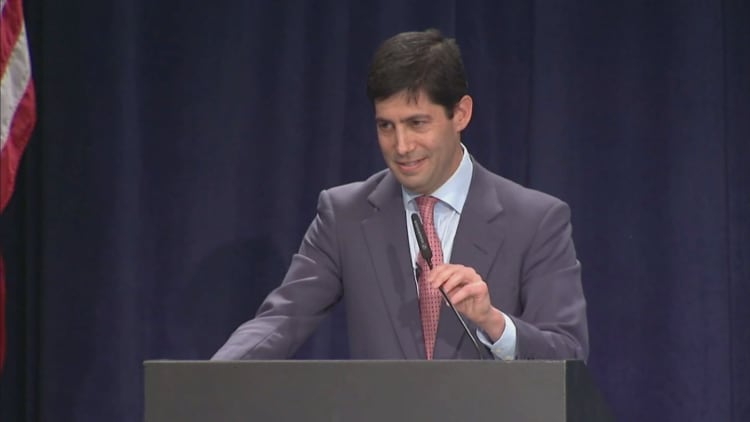

Kevin Warsh, the favorite to be the next chairman of the U.S. Federal Reserve, apparently believes the central bank has become a servant to the stock market after years of loose monetary policy.

Uber-bear Albert Edwards, an economist at Societe Generale's strategy team, said Monday that after listening to Warsh speak at a banking conference last week, he would be his choice to lead the Fed. He also revealed Warsh felt the Fed had been captured by the "secular stagnation" ideas of former U.S. Treasury Secretary Larry Summers and had become persuaded by the idea that more monetary stimulus is needed.

"Rather than admitting they are wrong, this group, who failed to predict the current economic malaise, have constructed this theory to explain why ever more stimulus is required. In particular Warsh warned that the Fed had become the slave of the S&P," Edwards noted.

"He (Warsh) got a rousing reception from the BCA (Research) audience as he talked a lot of sense – in particular on how the Yellen Fed has lost its way and current policy is deeply flawed," he added.

Warsh, a former Fed governor, met with both President Donald Trump and Treasury Secretary Steven Mnuchin on Thursday. He is viewed as more hawkish than Janet Yellen, whose current tenure ends in February.

Warsh's possible appointment has caused both U.S. bond yields and the dollar to move higher. Warsh was not immediately available for comment when contacted by CNBC.

As of Monday the PredictIt probability market had Warsh as a 33 percent favorite to be the next Fed chair, ahead of Jerome Powell on 26 percent and incumbent Yellen on 17 percent.

Too hawkish for Trump?

While Warsh may fulfil Trump's desire to reduce regulation, he may also want to raise interest rates at a more aggressive pace. This could be seen as a stumbling block to the president's stated preference for a low dollar.

But Aaron Kohli, director of fixed income strategy at BMO, told CNBC Friday that Trump may gamble on a dilemma that never comes to pass.

"It becomes muddier because most people that sit in that seat have to moderate their views based on reality, and the reality is that inflation isn't moving," said Kohli.

"As much as we believe he would taper aggressively, and raise rates aggressively, it might not come to that."

WATCH: Here's how the market will react if Trump chooses Warsh as next Fed chair