The technician who called oil's rally through the beginning of fall says that a bigger rally is in store for the commodity, and that investors should buy the recent dip.

In July, when oil was sitting around $46 a barrel, Scott Redler of T3Live.com predicted that crude could run above $51. The commodity actually surged 9 percent in September, breaking above Redler's predicted $51 level near the end of the month, and now the technician sees it going even higher.

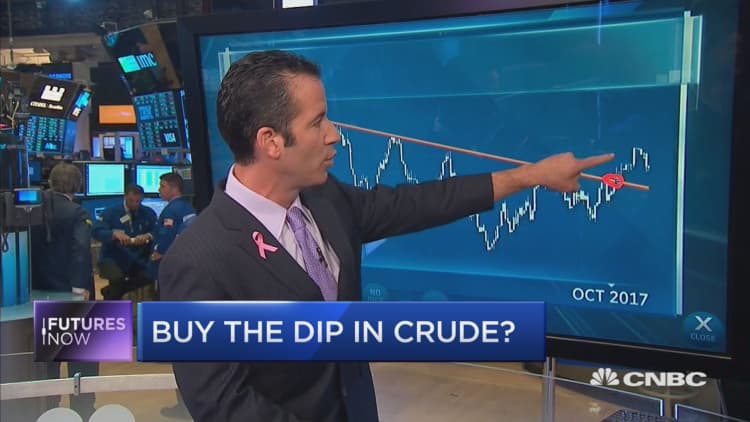

More specifically, Redler believes that crude saw new "momentum" to the upside the moment a "descending trend line" was broken in mid-September. While the commodity has since fallen more than 5 percent from that $53 high at the end of September, Redler says that crude is heading back toward that downtrend line, and that based on momentum oil will bounce again.

"If you want to buy a dip, you can potentially buy this spot which is around $50," he said Tuesday on CNBC's "Futures Now." "And if this test holds, because sometimes you retest a descending channel, I do think the next move is going to be to the upside."

In other words, with oil still trading at $50 even on Wednesday, Redler is essentially saying now is the best time to buy crude.

As for how high oil could go, based on the momentum Redler sees in the charts he believes oil could return to $60, which it hasn't hit in more than two years.

"If we go back up to that $53 and get above it, I think in the first or second quarter of next year there's a good chance we're going to see it close to $60, which would be a nice tradeable move," he said. "So you can maybe buy the dip into this $50 area in crude, it gets above $53, and you play some momentum longer- term to $60."

If that rally in crude does play out, Redler says he sees XLE, the ETF that tracks energy stocks, surging as high as $74. That represents an 8 percent climb from XLE's Wednesday levels.

Crude held steady near $50 on Wednesday, though the commodity has dropped 6 percent year to date.