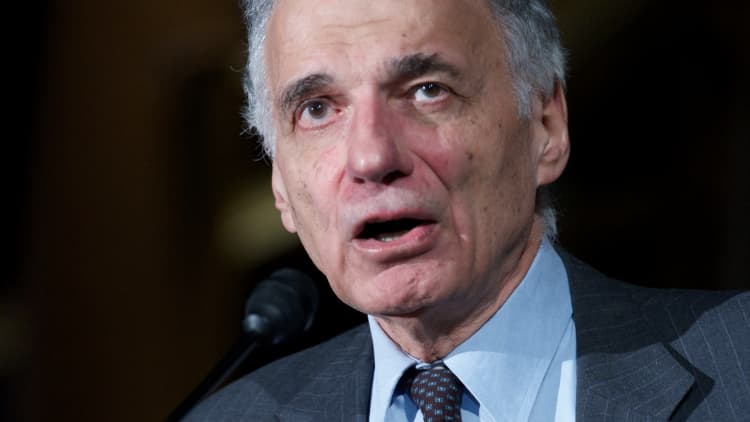

Consumer advocate Ralph Nader said Monday that share buybacks are a sign of poor corporate management.

Why isn't "all this capital being spent for productive plant and equipment, or sent back into dividends to increase consumer demand, or shoring up shaky pension plans or going into research and development?" Nader said on CNBC's "Halftime Report."

"When they buy the stock back, when it's near its high, is a sign of unimaginative or incompetent or avaricious management," Nader said.

Share buybacks reduce the share count of a stock, increasing earnings per share and theoretically benefiting shareholders. The buybacks have also helped fuel the stock market rally.

However, critics such as Nader say the benefits are temporary and the cash would be better used in investments such as capital expenditures.

"There've been seven trillion dollars that these corporations have spent, which belongs to the shareholders, just buying back their stock in order to meet certain contrived pay performance for their executive suite," Nader said. "So it's basically for their own pay increase because stock buybacks don't create anything tangible, they temporarily increase the earnings per share."

Nader pointed to General Electric and IBM, which have conducted "hundreds of billions of dollars" in share buybacks over the years. Those stocks are "languishing" or "going down in a bull market," he said. "Other companies that didn't do that, their stocks are doing much better."

GE shares are down nearly 26 percent this year, while IBM has fallen 11 percent. The S&P 500 is up nearly 14 percent at record highs.

Nader also said that rather than buying back stock Wal-Mart could have invested in research and development to compete better against Amazon.com.

IBM in response pointed out its acquisitions, capital expenditures, and research and development in fields such as blockchain and cybersecurity. The company also referred CNBC to a 2014 commentary piece by CFO Martin Schroeter about how the company has prioritized investment in the business. "Stewardship also requires that we do more than just invest, it requires that we return capital to our owners," the commentary says.

GE declined to comment. Wal-Mart did not immediately respond to a CNBC request for comment.

Share buybacks, which rose to records and fueled the bull market, are actually on the decline recently.

The number of S&P 500 companies buying back shares fell 9.8 percent in the second quarter from the prior quarter, and declined 14.5 percent from the second quarter last year, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. On the other hand, dividends hit a record $104 billion in the second quarter, Silverblatt said.

WATCH: The problem with share buybacks