Sen. Ted Cruz said Friday that killing the estate tax will mainly help the working class because "the super rich don't pay it." But IRS statistics show the opposite.

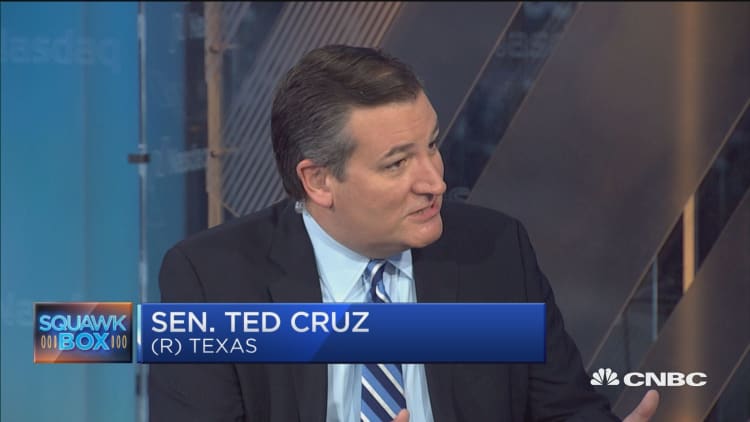

In an interview with CNBC, the Texas Republican sought to dispel criticism that eliminating the estate tax mainly helps the rich. He said the rich avoid the tax with tax planning, and that it's mainly paid by farmers and family businesses that are forced to sell when the founder dies.

"The billionaires?" he said. "They don't pay the estate tax. The really rich? They don't pay the death tax. They hire lawyers and accountants, they do generation-skipping trusts. You think the George Soroses of the world are paying the death tax?"

Cruz added: "The people who pay the death tax, who I talk to all the time, are farmers out in west Texas who are growing cotton, who are struggling hard."

Small-business owners also bear the brunt of the tax and that it costs middle-class jobs, he continued. "The people who pay the estate tax are the small-business owners that have a small factory that when the patriarch passes on, the next generation sells the factory and fires the workers."

Yet an analysis of IRS data by the Tax Policy Center shows that while many of the wealthy do minimize their estate tax payments — mainly by giving to charity — the rich pay most of the tax. Farmers and small businesses represent a nearly nonexistent share.

According the Tax Policy Center, about 11,300 people who die this year will have estates large enough to be subject to the tax.

The tax only applies to the value of an estate over $5.49 million for individuals and just under $11 million for couples. So that would have to be a pretty nice cotton farm.

Of the 11,300 people with potentially taxable estates, only 5,460 will actually owe any tax. It's the breakdown of that group that matters.

According to the Tax Policy Center, nearly two-thirds of the estate taxes paid come from the top-earning 1 percent. Of the roughly $20 billion in estate taxes that are expected to be paid this year, more than $12 billion comes from the top 1 percent. More than a quarter of all the taxes paid are paid by the top 0.1 percent.

Of the more than 5,000 estates paying the tax, only 80 or so are small businesses or farms, according to the Tax Policy Center. And they don't pay very much. Small businesses and farms combined will pay about $30 million in tax — or about 0.15 of 1 percent of total estate tax revenue.

It's entirely possible that Cruz hears from struggling cotton farmers who are subject to the estate tax. But there aren't very many of them. And there are far more billionaires and multimillionaires who do pay — but won't have to if the death tax dies.