Tech valuations continue to climb, and according to one industry expert, it's the result of an evolving winner-take-all system in the industry.

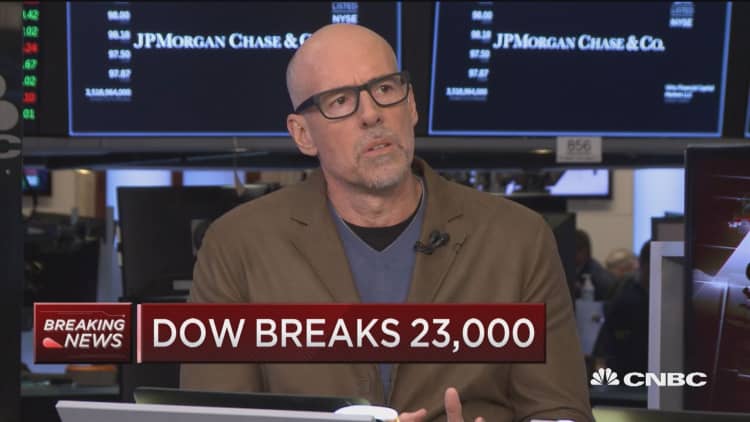

"If you look at the valuations, the number one player has more than the valuation of the next five or 10 combined," Scott Galloway, professor at NYU's Stern School of Business, told CNBC's "Squawk Alley" Tuesday. "When I was starting companies in the 90s, there was sort of three or four companies that were doing okay. Now it really is winner-take-all."

Galloway said companies like Uber — with a valuation of $70 billion according to recent company press releases — would likely be worth much less if subjected to the scrutiny of the public market. The inflation, he said, comes from market dominance.

"I think the algorithm for creating shareholder value in the private markets right now is: Find a great market, put together a great team, have technology at the heart, and establish your position as the perceived leader," Galloway said.

Uber's biggest U.S. competitor, Lyft, for example, was valued at $7.5 billion in its latest funding round in April — just one-tenth of Uber's reported valuation.

"This valuation number is hard to even call it a number," Galloway said. "It really is an illusionist trick."

Galloway is the author of a recently released book, "The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google."