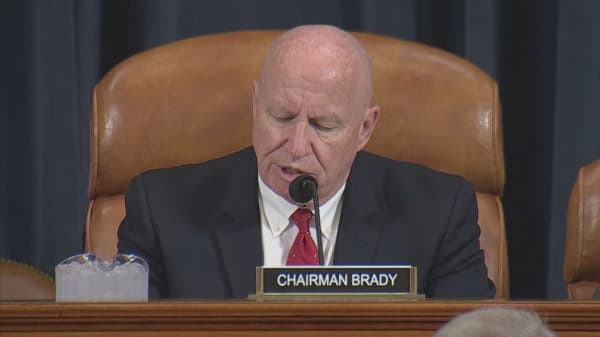

Republicans in Congress are planning to include a proposal in their tax reform bill that would push millions of Americans to save less for retirement. Despite President Trump tweeting his strong and unambiguous opposition to the plan on Monday, House Ways & Means Committee Chairman Kevin Brady made clear on Wednesday that the proposal that makes changes to 401(k) retirement savings plans is still likely to be included in the House Republicans' tax legislation scheduled for committee consideration next week.

This proposal is not really about retirement policy. Rather, it is one of several efforts by Republican lawmakers to make up for the federal revenues that will be lost when they slash corporate tax rates and give massive tax cuts to the highest-income Americans. In essence, it would raise taxes on middle-class retirement savers to fund tax cuts for the wealthy.

America is already in a retirement savings crisis. This proposal would exacerbate the crisis. The vast majority of today's American households will not have enough retirement income to maintain their pre-retirement standard of living. Fewer than a quarter of baby boomers-those reaching retirement age right now-think they will have enough retirement savings to last the rest of their lives.

Simply stated, many Americans-perhaps most Americans-are on a path to outlive their money in retirement. They need to save more for retirement, and grow those savings. The Republican tax proposal would encourage them to save less. Here's how it would work.

Under existing law, working people can contribute up to $18,000 to a 401(k) account (an employer-provided retirement plan) without that money being subject to federal income tax until it is withdrawn. The Republican proposal will dramatically reduce the cap on tax-free contributions by 87 percent to only $2,400.