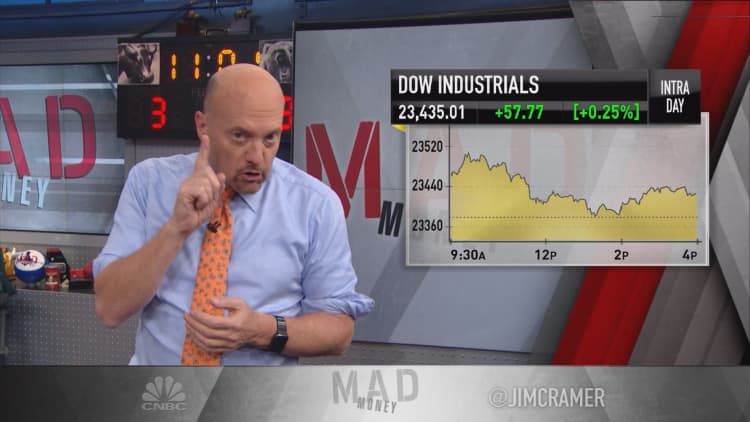

Some may think that CNBC's Jim Cramer is foolish for not being afraid of the red-hot bull market, but in reality, he's just trying to make you money.

"I am actually less worried about looking like an idiot and more concerned that you might be scared away from the stocks by the tepid conventional wisdom. That's why I think it's so important that you have to understand how a bull market like this one operates," the "Mad Money" host said.

The rules for investing in bull markets are different, so Cramer went over his 6 key guidelines for how to look at stocks when rallies become routine.

1. New Disciplines

In a strong bull market, stocks can go much higher than many investors and analysts expect.

"In a normal market, the disciplined thing to do is sell when you have a decent gain. But now that the economy's healthier — synchronized global expansion — and the market's roaring, there's a new discipline," Cramer said. "You need to learn how to hold onto terrific stocks of terrific companies, because there's a good chance that the upside will be greater than you imagine."

Cramer pointed to the stock of Adobe Systems as an example. His charitable trust sold its position in Adobe after a 40-basis-point run in the stock and an announcement from Adobe that said growth could slow in the coming quarters. Initially, it seemed like the disciplined thing to do.

"The whole equation's changed. In a bull market, you need to put more emphasis on not missing gains rather than simply trying to sidestep possible losses. In short, you have to be able to stay the course, even when it flies in the face of your instincts," he said.

Since Cramer's charitable trust sold Adobe, shares have run up another 30 basis points and, according to technician Bob Lang, could continue running higher.

2. Analysts Matter

In Cramer's simple terms, "the analysts now matter."

It took years for analysts to regain Wall Street's trust, but they have re-asserted their power to get individuals and institutions to buy or sell stocks, Cramer said.

"In a bear market or even a neutral market, these people don't really matter unless they're saying something negative," he said. "But in a bull market their positive pronouncements are suddenly taken seriously, which is how upgrades can cause such big moves."

3. Silly Action

Investors need to understand that bull markets behave irrationally.

Cramer used to make the joke to clients of his hedge fund that $90 stocks will go to $100, almost by design.

"Clients would look at me like I was nuts, but then they'd watch and it would happen," he said. "It's ridiculous. It's illogical. It's the opposite of how markets are supposed to behave, but you'd be amazed at how often this silly rule of thumb actually works in this kind of bull market. It's momentum talking, but momentum carries a lot of weight in this kind of bull market."

4. VIP Status

Lots of stocks become "anointed" in bull markets, Cramer said.

In tepid markets, it's common that only FANG — Cramer's acronym for the stocks of Facebook, Amazon, Netflix and Google, now Alphabet — is able to run.

But now, industrials like Caterpillar, Honeywell, Boeing and others are gaining VIP status on Wall Street, too.

5. Ignoring Negatives

Bull markets also tend to brush off negative news.

"Congress still hasn't come up with any sort of tax reform package that has any hope of passing, and does anyone even remember the president's $500 billion infrastructure plan? The truth is, it doesn't really matter," Cramer said.

6. Valuation Inflation

In a bull market, you'll find plenty of investors happy to buy into expensive stocks.

"The big institutional money managers decide that a certain stock is worth owning, and when they get new money in they buy more of it. Endlessly," the "Mad Money" host said.

Cramer noticed that it often doesn't matter to investors that they're paying too much for a given stock, as long as it's beloved by the rest of the market.

Final Thoughts

Cramer doesn't like a lot of these changes, but they're not widespread yet and have been met with resistance from people who worry we've run up too far too quickly.

As such, Cramer wouldn't be opposed to investors taking profits here, particularly in white-hot stocks like Nvidia. His charitable trust recently advised investors against buying into Nvidia at these levels.

He added that investors should use bull markets like these to "take out the garbage" and get rid of stocks in under-performing sectors like foods and pharmaceuticals.

"These aren't my rules, but I remember them and I respect them, even if I don't necessarily want to play by them. I know it's not rigorous to buy a stock that's [at] $90 because it's going to go to $100. However, this is what I call learned behavior speaking and one of the few, and I mean few, things that's good about getting old is that I can remember the 1980s and the 1990s and I know that we're not yet all that far along with this kind of action," the "Mad Money" host said. "There's a lot of bull left to play."

WATCH: Cramer outlines special bull market procedure

Disclosure: Cramer's charitable trust owns shares of Facebook, Alphabet and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com