The Republican tax plan starts with big advantages, and big problems that make the outcome of the debate uncertain.

Let's start with the advantages.

American business wants it to pass. Corporate executives, who complain the top U.S. rate of 35 percent hobbles them against foreign competitors, get a large cut to 20 percent. Unincorporated "pass-through" businesses get a 25 percent top rate, down from the 39.6 percent they can now face under the individual tax code.

Republicans believe deeply in tax cuts, both as a means of limiting government and as a tool for boosting economic growth. They control both Congress and the White House and operate under rules that allow them to enact their plan without a single vote from Democrats.

Moreover, those Republicans increasingly see tax cuts as a matter of political survival. With their business donors and voting base already dispirited over failures on other issues such as health care, botching tax cuts trigger a collapse that hands Congress back to Democrats in 2018 elections.

That doesn't eliminate their problems, which remain substantial.

The GOP holds narrow majorities and faces significant ideological divides. Leaders can only lose two Republican senators and still pass the bill, which makes any individual objection significant.

The congressional budget plan permits the tax bill to boost the deficit by $1.5 trillion over 10 years. That's too much for some fiscal conservatives who worry about the federal debt —including Sen. Jeff Flake of Arizona who criticized the plan Thursday.

The plan gives businesses tax cuts more than three times as it gives individuals, and early analyses suggest some individual taxpayers would actually pay more. Sen. Marco Rubio of Florida on Thursday said he wants the child tax credit, which would rise from $1,000 to $1,600 under the plan, to go up even more.

Regional opposition could also be decisive. There are 35 House GOP members from New York, New Jersey, Illinois and California — states that would be hit by the plan's elimination of the federal deduction for state income taxes. That's more than enough to sink the bill if they hold together in opposition.

Specific sectors of the economy can also cause trouble. Homebuilders and Realtors have announced their strong opposition over new curbs on the value of tax deductions for mortgage interest.

And as Republican leaders try to surmount these obstacles, public support for the plan is weak as the debate gets underway. In this week's NBC News/Wall Street Journal poll, just 25 percent of Americans called the plan a good idea, 14 percent said it would reduce their tax bills, and 19 percent said it would give the economy a big boost.

Another challenge is the political weakness of the most important single voice in the debate — President Donald Trump. His approval in the NBC/WSJ poll fell to 38 percent, its lowest point this year.

The president has sent mixed signals on his preferences for the bill. He has strained relations with Republican leaders to begin with.

Asked about prospects for progress on the bill recently, House Speaker Paul Ryan noted that Trump is heading off for a 10-day trip to Asia. He said he was joking.

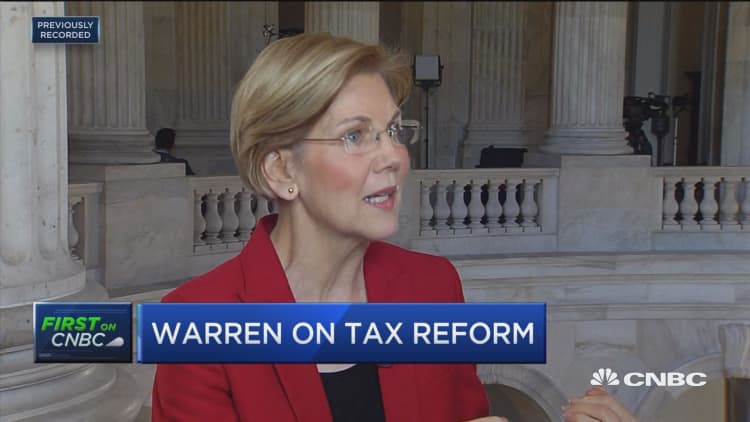

WATCH: Sen. Warren explains why she's against GOP tax plan