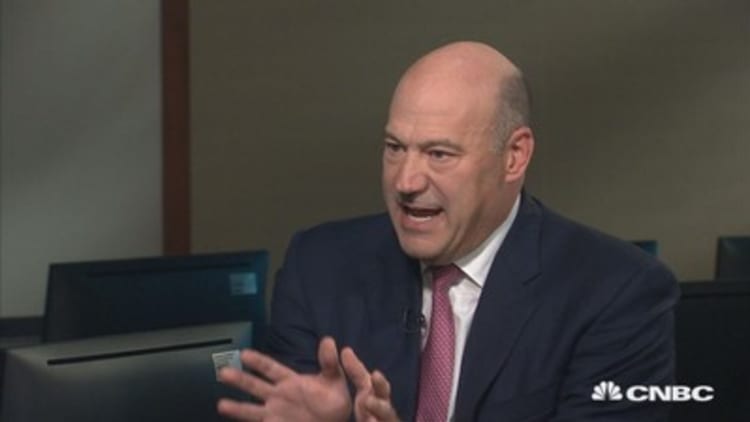

CNBC's John Harwood sat down with National Economic Council Director Gary Cohn to discuss a range of topics, including the GOP effort to repeal the estate tax. What follows is a condensed, edited transcript of their conversation.

Harwood: Why do estate tax at all? If you preserve step-up basis, that means many capital gains for your kids, for Donald Trump's kids, will never be taxed.

Cohn: Let's wait and see where the final plan comes out. On the estate tax, if you look at the couple of groups who are the biggest advocates for repealing the estate tax, it really is the pass-through business and it's the farmers.

Harwood: It's Donald Trump, Gary Cohn, people like you guys.

Cohn: Gary Cohn doesn't care about the estate tax, I can guarantee you. I can guarantee you.

Harwood: You're the one who said only a moron pays the estate tax.

Cohn: I can guarantee you Gary Cohn doesn't care about the estate tax.

Harwood: When you look at the actual number of real farms that pay the estate tax, it is tiny — in the dozens.

Cohn: Well, I think people have managed to keep themselves below the estate tax. This is the whole issue. Many people are smart enough to know how to manage themselves out of the estate tax. So, if you have a family farm that's big enough that it's going to hit the estate tax, you start paying lawyers, consultants, and accountants to break up your land, and break up your farm, and giving it to the kids when the families would prefer to keep the farm intact, keep it whole, and manage it as one big farm.

We're forcing people into irrational behavior, when we'd like to keep them in rational behavior, and run the farm as one big farm.

Harwood: Are you seriously saying with a straight face that getting rid of the estate tax is about farmers and not about very wealthy families?

Cohn: What I'm saying is that it benefits farms, it benefits small businesses, it benefits a lot of different people.

Harwood: Small businesses with more than $11 million estates?

Cohn: We do not believe that death should be a taxable event.

Harwood: How does it stimulate the economy?

Cohn: Well, look, we want that farmer to go out and buy the next piece of land, and the next piece of land, and the next piece of land, and create the economies of scale and be able to compete in the world. That makes sense to me. We want the small business to go double the production line and not have to worry about the size of his factory, worrying that, "Oh my God, I may incur estate tax and my family is going to have to sell this business."

Read more from the Gary Cohn Speakeasy interview:

... on keeping companies in America.

... on Goldman Sachs and the White House.

... on Cohn's plan after tax reform.

... on the value of trickle-down economics.