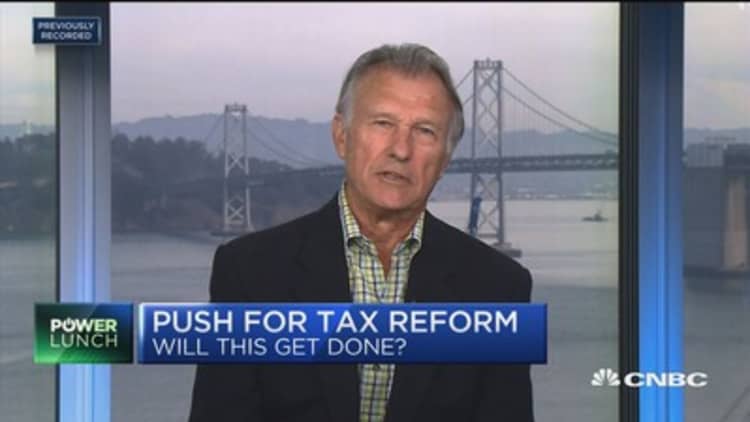

There may be concerns about the impact of the Republican tax reform bill on the housing market, but former Wells Fargo CEO Richard Kovacevich told CNBC on Tuesday that it is mainly the rich who will feel the pain.

The House GOP plan halves the deduction of mortgage debt for newly purchased homes to $500,000, while the Senate bill leaves it intact at $1 million. However, the Senate proposal calls for the elimination of state and local tax deductions. The House bill limits those deductions.

Kovacevich told "Power Lunch" the changes may slow down the real estate market for a short time. However, he doesn't believe it will cause long-term harm to the housing market.

"There is no tax advantage to own a home in the United Kingdom or Canada," he said, noting their homeownership is at the same level or higher than the U.S.

"The people who really get hurt are the people who can afford it."

Plus, the proposals double the standard deduction, so more people won't be taking the itemized deductions anyway, he said.

"You can't have tax reform unless you get rid of some of the incentives," he said. "It has to start somewhere."