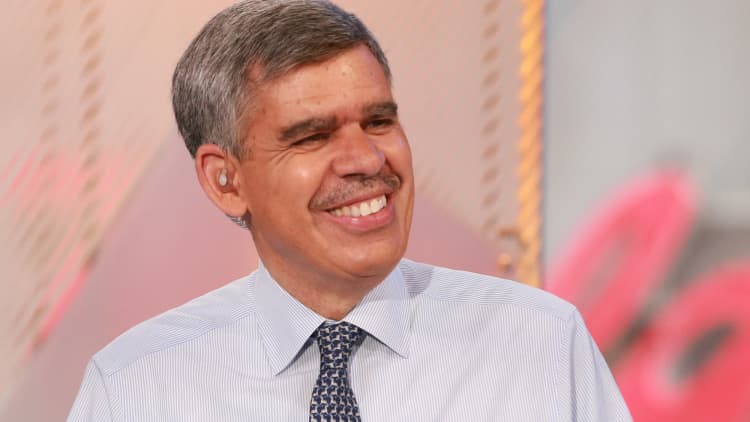

Prominent economist Mohamed El-Erian, rumored to be in line for a top job at the Federal Reserve, praised the central bank Friday for navigating its way out of crisis-era monetary policies.

In addition, he said policies from the Trump administration are helping the Fed along and pushing the economy higher.

The Fed is on the cusp of its fifth rate hike since beginning a normalization effort two years ago. In addition, it also in October began reducing the mammoth $4.5 trillion balance sheet it built up during quantitative easing bond purchases made to lift the economy out of its Great Recession malaise.

It's done all that, El-Erian said during a speech at the Rabobank Food and Agribusiness Summit in New York, with remarkably little upset to financial markets.

"We are in the midst of a beautiful normalization of Fed policy," said El-Erian, chief economic advisor at Allianz and former CEO of bond giant Pimco. "Forget the [2013] 'taper tantrum.' The Fed learned a lot from that. The Fed has been able to raise rates four times, to change market expectations, to stop QE, to announce a timeline for reducing its balance sheet, and it has done all that without disrupting markets or derailing the economy."

Indeed, the Fed's path lately has been smooth, though its critics say the central bank's extreme accommodation has led to distortions in asset values, particularly in the stock market, and an uneven distribution of wealth during the recovery.

The latest leg of the bull market that began in March 2009 has seen the tack on 17 percent in 2017, for a total rise of nearly 300 percent.

El-Erian pointed out that the Fed has eased a market into anticipating a rate hike in December, even though it was seen unlikely just a few weeks ago.

El-Erian has been mentioned as a possible successor to Stanley Fischer as Fed vice chair. He declined comment about his prospects when asked Friday by CNBC. Fischer resigned in mid-October, citing personal reasons.

Should he gain an appointment, it will come at a critical juncture for the central bank and its policymaking Federal Open Market Committee. With three vacancies currently open — President Donald Trump has nominated Carnegie Mellon economist Marvin Goodfriend to fill one — likely another on the horizon and the New York Fed president's position being filled, the future could be filled with change.

El-Erian said investors can be "very confident" the Fed can continue with its "beautiful normalization" that will be buttressed by help from fiscal policy in Congress.

"We're having a shift that the U.S. economy has been waiting for a long time, from an excessive reliance on monetary policy to a more balanced policy stance," he said. "The more balanced policy has three elements — two of which are being implemented, the third of which is on the schedule to be implemented."

Specifically, he said deregulation and tax reform changes are in the pipeline or have been accomplished, while the Trump administration has promised infrastructure spending ahead.

"Policies are contributing to growth," El-Erian said. "The Fed can and is normalizing in an orderly fashion, and of course the marketplace has embraced this wholeheartedly."

WATCH: Fed Chair Janet Yellen talks about central bank strategy ahead.