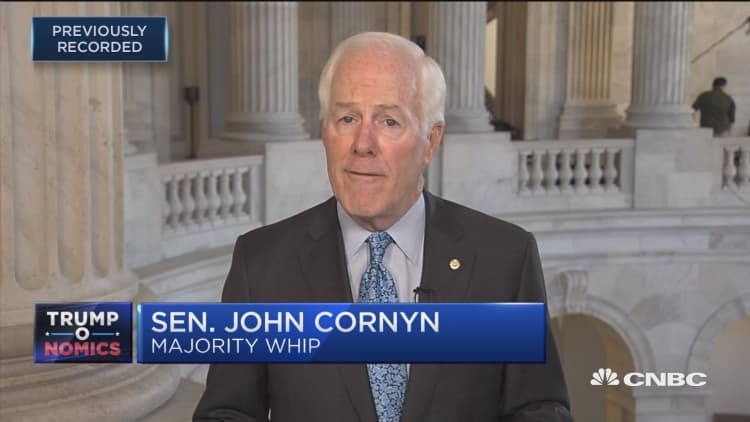

Sen. John Cornyn, the No. 2 Senate Republican, signaled Thursday that the GOP could tweak its treatment of popular tax deductions in its final tax bill.

The separate bills passed by the House and Senate scrap most state and local deductions but leave up to $10,000 in property tax deductions in place. As the chambers move to strike a joint plan in a conference committee, some House members in high-tax blue states have pushed for a state and local income tax deduction, as well.

Cornyn, a Texas Republican, suggested Thursday that more changes to those tax breaks could come.

"I talked to [House Majority Leader Kevin] McCarthy the other night, and he did tell me that this is an item of contention in the House," the Senate majority whip told CNBC's "Squawk Box." "I don't know what's going to happen to that. We did adopt the $10,000 deduction for property taxes but there may be some movement in that space. I, frankly, would anticipate that."

Senate Majority Leader Mitch McConnell on Wednesday said he is open to expanding the state and local deductions to appease House members.

Lawmakers in states like California, New York and New Jersey have pushed back against limiting those tax breaks. Due to the proposed changes, some taxpayers in those states could actually see a tax increase under a plan billed as an overarching tax cut.

Limiting the deductions is a tool to raise money and offset some of the costs of broad cuts to business and individual tax rates.

If lawmakers expand the state and local deductions or other tax breaks, they will likely have to find other ways to raise revenue. One possible method is cutting the corporate tax rate to 22 percent, rather than the proposed 20 percent, from the current 35 percent.

Cornyn on Thursday said he hopes the proposed corporate rate will stay at 20 percent.

WATCH: Concerns mount over eliminating state and local tax deductions