The chief tax writer in the House confirmed Thursday that a bill Republican leaders in Congress hope to send to President Trump next week has a top individual rate of 37%, which is lower than both the House and Senate said it would be in bills passed in recent weeks.

The bill would also lower the top corporate rate starting Jan. 1 from 35% to 21%, a tick higher than the 20% contained in both bills and a year earlier than the Senate had been seeking.

More from USA Today:

Rubio threatens a 'no' vote, Lee a maybe unless child credit is expanded

Here's what's in the tax bill the House just approved

Key provisions of the Senate tax bill may be a tough sell in the House

The bill would keep the estate tax, the alternative minimum tax, and the deduction for serious medical expenses, all of which the House bill would have eliminated. It will eliminate the penalty for not having health insurance, a key plank of the Affordable Care Act, known as Obamacare. And the bill would put new limits on deductions for mortgage interest and state and local taxes.

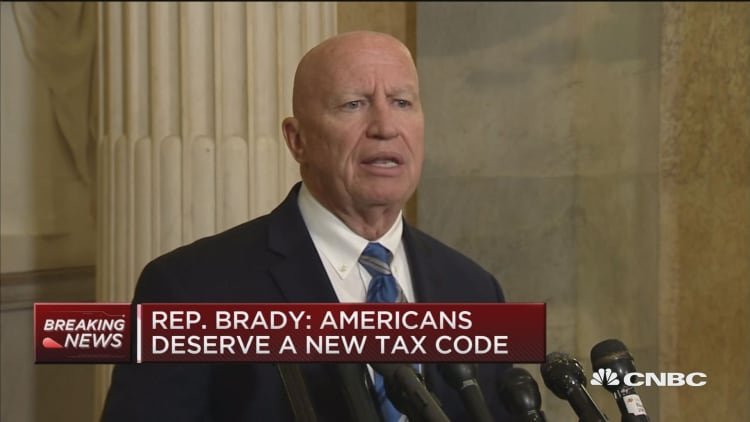

A House-Senate conference committee working to mesh competing tax plans will release their final agreement Friday afternoon, said Ways and Means Committee Chairman Kevin Brady, R-Texas. The House and Senate are expected to vote Monday and Tuesday, though the order of votes is unclear, especially since several senators whose votes the GOP would need are wavering.

The top individual tax rate, currently 39.6% on income over $470,700 for couples, would have changed to 38.5% on income over $1 million in the Senate bill, while the House kept the 39.6% rate while raising the income level to $1 million.

Brady confirmed the new 37% rate, but did not say what the income level for the top bracket would be. He said it was not designed to give the wealthy a last-minute break, but rather to address concerns from high-tax states such as California and New York that were concerned about the impact of restricting the deduction for state and local taxes.

Under the conference plan, that deduction would be capped at $10,000. Where both the House and Senate bills made it available only for property taxes, the final plan would also allow for a maximum $10,000 deduction of property and income taxes or property and sales taxes.

Asked why there was no effort to apply relief for people in lower income brackets losing the deduction, Brady said other parts of the tax plan would help them, including increasing the standard deduction from $12,400 to at least $24,000 for couples and increasing the child tax credit and how many families qualify for it.

"When you look at doubling the standard deduction, a bigger zero rate bracket, this new family tax credit ... (and) who's eligible to get it, boy that is tax relief for middle income families in a big way," Brady said.

But Rep. John Faso, R-N.Y., said he remained concerned about the impact of cutting the deduction, especially since it would happen immediately on Jan. 1.

"Many people have created and organized their economic lives, their mortgages, where they live, what school district they're in, based upon the deductibility, especially in the high-tax states," Faso said. "As of Jan. 1, this potentially has a significant impact on a lot of those plans and arrangements people have made."

Faso said he was undecided about the bill. Rep. Leonard Lance, a Republican who represents one of the wealthiest parts of New Jersey, said he remains a "no."

"For me, $10,000 regardless of the configuration is not strong enough," Lance said. He said the 37% rate may help his constituents, but he believes as a matter of federalism that Washington should recognize states have the right to set their own tax rates.

"I want taxes to go down on all Americans and I don't think there should be winner states and loser states, and New Jersey contributes more to Washington per capita than any state in the nation," Lance said.

Trade groups representing realtors and home builders opposed the tax bill because of changes to the deduction, and warned it would drive down property values.

Brady was a longtime sponsor of a bill to eliminate the estate tax, and the House bill would have done that within six years. In the end, conferees are expected to accept the Senate's plan to keep the tax with a sharply increased exemption.

"These are issues you have to work through with the House and the Senate here," Brady said. "I do think that at the end, it is a doubling of the exemption that will help a lot of family owned farms and businesses."

Brady indicated, but would not confirm, the bill would accept the Senate's plan to repeal the Obamacare mandate that people have insurance or face a fine from the Internal Revenue Service. The mechanism was designed to prod younger, healthier people to buy coverage, thereby lowering the insurance risk and rates charged to all buyers.

Not having the mandate is expected to reduce the number of people buying coverage both voluntarily and because coverage becomes too expensive. Not covering them will reduce how much the government pays for subsidized coverage.

Brady said that change helped offset the cost of continuing to have the deduction for high medical expenses, provision the House would have eliminated but the Senate not only kept but expanded for two years.

"The individual mandate that came from the Senate also allowed them to maintain and really even provide a little more relief on the medical expense deduction," Brady said. "That seems, it always seemed to me like an appropriate connection."

WATCH: GOP releases tax plan