It's a riddle, wrapped in a mystery, inside an enigma. Otherwise known as bitcoin.

Bitcoin's meteoric rise has captivated Wall Street and Main Street alike. Among one of the biggest unknowns surrounding the cryptocurrency is how to value it, and it's stumped even the most veteran market watchers.

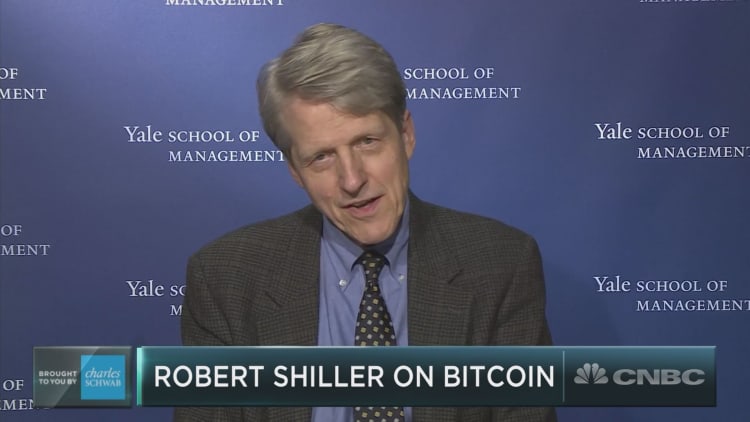

Enter Robert Shiller, who has made an award-winning, legendary career of assessing asset prices; after all, that's precisely what he won the Nobel Memorial Prize in Economic Sciences for in 2013.

But perhaps never before cryptocurrencies' utter domination in the marketplace this year has he explored an asset's pricing or valuation quite as ambiguous.

In a recent New York Times column, "What Is Bitcoin Really Worth? Don't Even Ask," Shiller explored bitcoin's value and what investors' frantic sentiment surrounding the cryptocurrency says about our own psychology.

Shiller elaborated on his assessment of valuing bitcoin in an interview with CNBC's "Trading Nation" on Monday afternoon.

"I think that the value of bitcoin is exceptionally ambiguous," he said.

"There is the medium of exchange function that it's offering, and there's also a store of value function; that is, you can hide away your wealth in there. And it's mobile; you can go anywhere, and get at it. How valuable is that, though? I don't personally see any value to that. That's the problem; they have a really clever technique to generate something, and it could be valued. But that's why it's especially likely to become a bubble, because when you see people valuing it, you start to wonder, 'Maybe they're right,'" Shiller said.

"The fascination people have with bitcoin is partly because of the mystery of money itself. Why do these pieces of paper have value, and couldn't something else have value? Plus, we all believe in a first-mover advantage. Bitcoin was first," he said, referring to its status as the first-ever cryptocurrency, the idea first unleashed in 2008.

Bitcoin has continued to thrive under several psychological ideals, Shiller said; investors have embraced the cryptocurrency as the first in its class and the alluring tale of its mysterious creator, "Satoshi Nakamoto."

"People believe in 'first mover,' and so it sounds right to them. I can't say that it's definitely wrong, but it sounds like a flimsy argument," he said.

Bitcoin's price has surged quadruple-digits this year and the cryptocurrency was launched this weekend on the world's largest futures exchange.