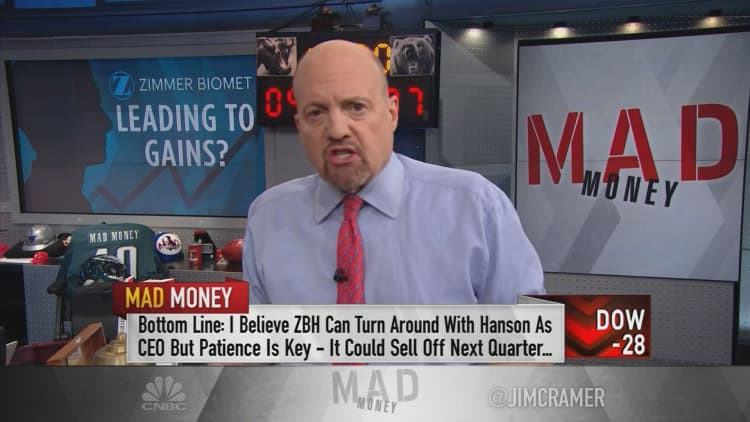

Over the summer, CNBC's Jim Cramer acknowledged that replacing Zimmer Biomet's CEO could be good for the company, but he didn't exactly pound the table on the stock.

"Good thing we didn't jump on the bandwagon, because for the last five months, Zimmer's stock has continued to fall, almost entirely as a result of two fairly ugly quarters," the "Mad Money" host said. "But this whole time, you could see just how badly people wanted to believe."

After each earnings miss, shares of the medical device maker would start to climb as analysts tried to call a bottom. But then the next bad quarter would arrive and the stock would once again tumble.

Then, on Tuesday morning, Zimmer named a permanent CEO. To Wall Street's delight, the company announced that former Medtronic executive Bryan Hanson would take the helm.

"The response was as bullish as it was dramatic," Cramer said. "Immediately after the news broke, two analysts upgraded the stock, and a third analyst who upgraded it beforehand in anticipation of a good hire named Zimmer her top pick for 2018."

Better yet, shares of Zimmer popped 6 percent, or nearly $7 a share, on the news.

Still, Zimmer's recent weakness is worth considering, especially for investors who are eager to jump on board with the orthopedic implant manufacturer's new leadership, Cramer said.

After David Dvorak, its former CEO, stepped down in July, the company reported a slightly weaker-than-expected quarter and cut its full-year guidance, still struggling with integration issues from its 2015 merger.

Even with Dvorak out, Zimmer's November earnings report wasn't much better: it missed on the top and bottom lines even after lowering its guidance in July and cut its forecast again.

Manufacturing issues seemed to be at the center of Zimmer's problems, which could have been why analysts and investors stuck with the stock, Cramer said. Manufacturing issues can be resolved, and with a new CEO on the horizon, the market seemed sanguine about the weakness.

Sure enough, when Hanson was appointed CEO, analysts' enthusiasm could hardly be contained. Goldman Sachs upgraded Zimmer's stock to "neutral" from "sell" and Wells Fargo upgraded it to "outperform" from "market perform" on the prospect of a successful turnaround.

Cramer was behind the bull case as well. He pointed out that Hanson executed successful mergers both at Covidien, where he was before Medtronic, and at Medtronic when the device maker bought Covidien.

The "Mad Money" host added that the appointment could be strategic. Some people think it could signal that Zimmer is considering a sale, potentially to Medtronic, Cramer said.

Given that activist firm Jana Partners (which helped orchestrate the Amazon-Whole Foods deal) still holds a large stake in Zimmer, Cramer said a future deal is possible, though far-fetched.

Plus, shares of Zimmer remain cheap relative to others in the industry, trading for under 15 times 2018 earnings estimates.

But Cramer insisted that investors be patient when it comes to buying Zimmer's stock, particularly because the company's upcoming earnings report in January will not yet reflect Hanson's impact.

"If Hanson under-promises, the stock will likely sell off again and that could be [a] terrific buying opportunity," the "Mad Money" host said. "But ... if you want to put a small position on in Zimmer Biomet betting that this could be the last bad quarter and the stock'll jump, be my guest, as this is by far the cheapest stock in the group because of all the things that have gone wrong. The problem is, remember, it could get cheaper still when we see the quarter, so leave a little room to back up the truck."

WATCH: Cramer examines Zimmer Biomet's improving outlook

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com