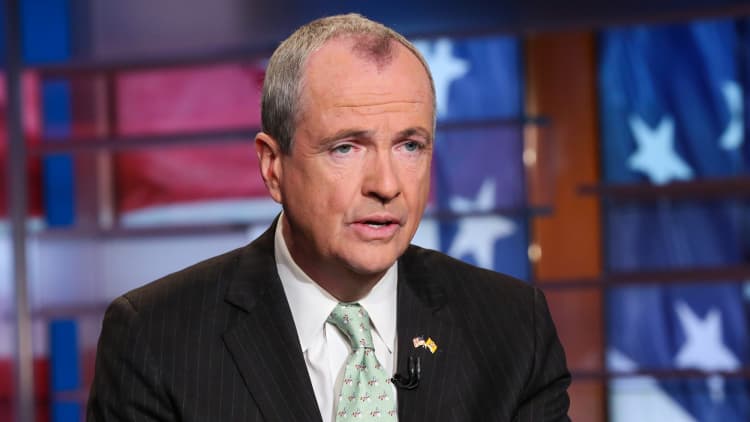

New Jersey Gov.-elect Phil Murphy told CNBC on Wednesday that the GOP tax plan making its way to President Donald Trump is an "awful bill for America."

Murphy, a Democrat, said on "Squawk on the Street" that New Jersey may seek to challenge in court the "legality and constitutionality" of the Republican package. In claiming "everything is on the table" to mitigate the impact of the bill, he also said state property taxes may go up.

"New Jersey has taken a backseat over the past number of years in challenging what's coming at us out of Washington," said Murphy, who takes over in January for the state's two-term Republican governor, Chris Christie. "New Jersey will ... look at all available means — both legal and otherwise — to challenge this [bill] or compensate for it."

Murphy said he's not a constitutional attorney, but questioned whether amendments to the bill, "a lot of them handwritten," to win over Republican votes will hold up.

"My going-in bias is there are going to be flaws. There are going to be holes. And if there are we will exploit them; I hope with other like-minded states," said Murphy, who like a number of Trump administration officials previously worked at Goldman Sachs. The governor-elect also was U.S. ambassador to Germany under former President Barack Obama.

Murphy also railed against the severe limit in the final GOP tax bill concerning how much state and local taxes Americans can deduct from their federal returns.

Asked about the impact on average New Jersey residents, he said, "It's many thousands of dollars." Though he did not point to any study or hard numbers to back up that claim.

Under current law for federal returns, the state and local tax deduction, better known as SALT, is unlimited. The House wanted to put a ceiling of $10,000 on property taxes alone. But the final Republican bill capped the combined state, local and property tax deduction at $10,000 for both single filers and married couples.

GOP tax writers were aiming to make up for curtailing SALT by lowering overall federal tax rates and doubling the standard deduction. But those measures may not be enough of an offset for the wealthy in high-tax states on the East Coast like New Jersey and New York and on the West Coast like California.

Opponents of the SALT deduction argue that wealthier Americans who face higher tax bills will move to lower-tax states.

"New Jersey was never a low-cost state to live in. We were always on our best day, the good-value-for-money state," Murphy said. "You pay a premium to live in a state like ours, but you get a lot back for that. Our job is to make folks feel like ... that premium was worth it."

Murphy said other high-cost, good-value states — such as California and Massachusetts — are seeing "humming" economies. That's the goal in New Jersey as well, he said.