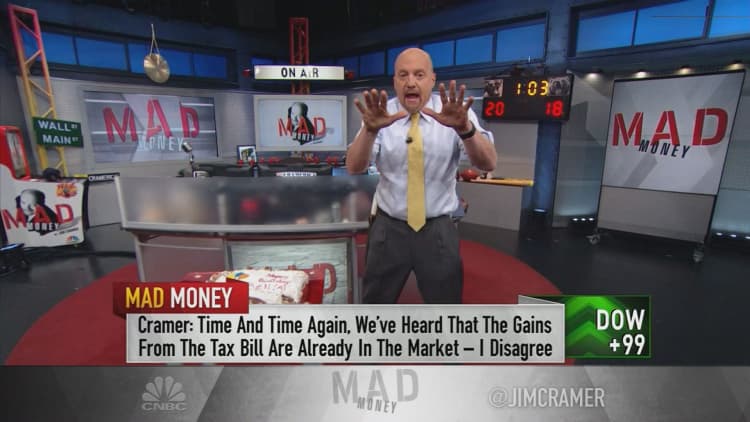

After a year of market chatter about the Republican tax overhaul already being "baked in" to the market, CNBC's Jim Cramer came out in full force against the claim.

As the "Mad Money" host reviewed Wall Street's latest research on Wednesday, he noticed an unusually high number of analyst upgrades and an unusually low number of downgrades.

Compared to the typical 10 upgrades and 5 downgrades, Cramer counted 29 upgrades of import and only two downgrades. The common thread?

"Tax reform. That's right, the very event that was supposedly baked into the [market], that all the graybeards ... said was being overblown, is proving to be the main reason for most of these positive analyst reports and upgrades," Cramer said.

The sudden change of heart made Cramer wonder why so many commentators told investors to stay out of the market because of the tax plan's effect on stocks.

"Frankly, I am outraged about this," he said. "I've been adamant that the surprise of tax reform — and come on, hardly anyone thought this bill could even pass as late as November — occurred so quickly that the analysts didn't even have a chance to revise their estimates."

Now, analysts are anointing a host of U.S.-based, high-taxpaying companies including Ulta Beauty, Dave & Buster's, Dick's Sporting Goods, General Mills and Waste Management all because of the tax plan's passage.

"You know what? I think these are all buys, every one of them," the "Mad Money" host said.

Here's how Cramer sees it: Ulta's spent enough time in the doghouse to start making a comeback; Dave & Buster's "experiential" positioning gives it plenty of room to expand; Dick's Sporting Goods can stand to rise with Nike and Under Armour falling back into favor; and General Mills deserved an upgrade after a better-than-expected quarter.

As for Waste Management, which caught a price target raise from Macquarie's research arm on Wednesday, Cramer said the company was poised for success as it tackled the post-hurricane cleanup in Texas and Florida.

"Can the stock actually hit $114?" Cramer wondered, referencing Macquarie's target price. "Hey, it's only at $87, but at this pace, other analysts will have to raise their price targets and the whole process will start all over again."

And as heated as the "Mad Money" host was about the recommendations, he couldn't deny that they were boosting the corresponding stocks.

Cramer recalled his time working at a major research firm, when research directors demanded for analysts to come up with buys for the following day.

"It's been 16 years since I've seen so many recommendations that actually move stocks, move 'em big. Believe me when I tell you it's contagious," he said.

With the market gearing up for another earnings season, Cramer wanted investors to be mindful of this dynamic and to keep a close eye on analyst reports.

"The analysts are under pressure from their research directors to pound the table," he said. "They want to get ahead of when the companies themselves take their estimates up. And guess what? This was day one of the process. Baked in? I think it's just getting started."

WATCH: Cramer (literally) slams "baked in" commentary on taxes

Disclosure: Cramer's charitable trust owns shares of Waste Management.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com