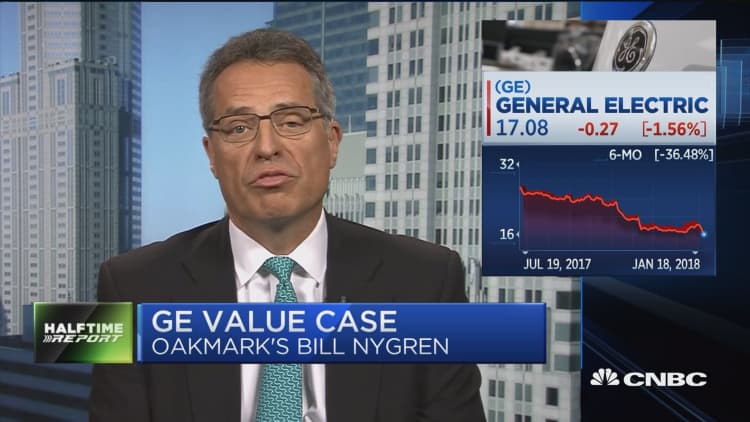

Shares of General Electric hit their lowest level since December 2011 on Thursday, briefly breaking below $17.

The Dow component closed at $16.77, a six-year low, down 3.3 percent. The move lower follows a 4.7 percent decline on Wednesday and a 2.8 percent drop Tuesday. For the week, GE shares are down 9 percent.

The latest sell-off began when the company announced disappointing results Tuesday after a review of its GE Capital insurance portfolio. GE will take a $6.2 billion after-tax charge for the fourth quarter of 2017, and the company expects to contribute $15 billion over the next seven years to shore up the portfolio's reserves.

CEO John Flannery said the company's "underlying strengths and value" are being "suppressed" in its current structure.

"As a result, we are looking aggressively at the best structure or structures for our portfolio to maximize the potential of our businesses, continue to deliver outstanding products and services to our customers, enhance our ability to provide attractive opportunities for our employees, while maximizing value for our shareholders," Flannery said.

But the potential breakup of the company has investors reflecting on what the individual pieces are worth.

J.P. Morgan analysts said in a note Wednesday that it is becomingly increasingly difficult to justify the firm's $16 price target on the stock. "This to us is not about offensive value creation and more an acknowledgement that the problems preclude the company from moving forward as previously planned, even a few months ago," J.P. Morgan wrote.

General Electric, one of the biggest conglomerates in the U.S., has seen its stock tank 45 percent in the past year.

— CNBC's Michael Sheetz contributed to this report.