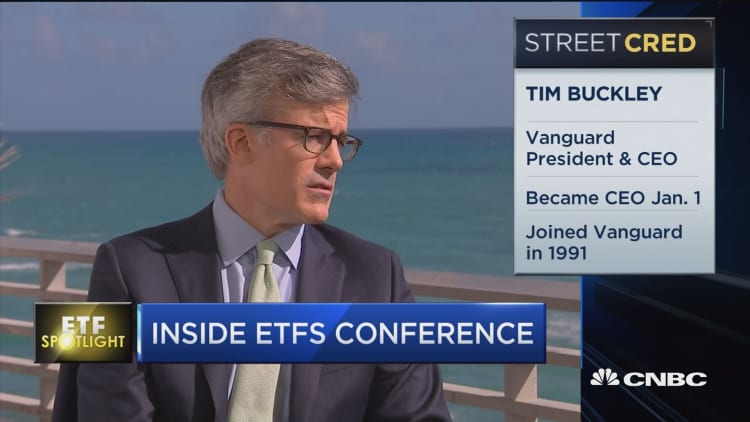

Vanguard CEO Tim Buckley may think highly of blockchain technology, but he isn't planning on investing in bitcoin anytime soon.

Buckley, who succeeded the firm's former chief, Bill McNabb, at the start of the year, oversees roughly $4.5 trillion in assets under management.

"You will never see a fund from Vanguard on bitcoin," Buckley told CNBC's Bob Pisani on Monday. "We tend to stay away from assets that don't have underlying economic value. They don't generate earnings or cash flows."

Digital currency bitcoin has risen and fallen dramatically over the past several months in what many investors consider a bubble-like move. Generated through a digital process called "mining," bitcoin derives much of its value from its scarcity. And given widespread appraising and volatile price moves, Buckley told investors he's steering well clear of the space.

"The bitcoin – its value is based off of scarcity – and an artificial scarcity that's out there," he explained. "It's really tough to imagine where the long-term return comes from other than speculation."

Buckley compared the lack of fundamental economic value in bitcoin to a lack of fundamental value in gold, an asset class which Vanguard also avoids.

Vanguard, based in Malvern, Pennsylvania, prides itself as one of Wall Street's most low-cost and conservative managers. Founder John Bogle's strategy of low-cost index fund investing has since swept across Wall Street.